Introduction:

As Africa emerges as a vibrant hub of technological ŌĆŹinnovation,Ōüó private equity firms are keenly eyeingŌüó theŌĆŹ continentŌĆÖs burgeoning potential.ŌĆī With ŌĆīanŌĆŹ influx of digital start-ups, a rapidly growingŌĆŗ consumer base,Ōüó and increasing smartphone penetration, the continent is at the precipice of a technological renaissance. In this context, the latest report from Private Equity International titled “Helios: Leveraging AfricaŌĆÖs Technology Boom” provides critical insights into how private equity firms like HeliosŌüŻ Investment Partners are navigating this dynamic landscape. By strategicallyŌĆŹ investing inŌüŻ technology-drivenŌüŻ ventures,ŌĆī these firmsŌĆŗ areŌüó not only capitalizingŌüż on the Ōüóopportunities presented by Africa’s digital evolution but are also playing a pivotal role in shaping its economic ŌĆīfuture. This article delves into the strategic maneuvers of HeliosŌĆŗ and the broader implicationsŌüż of their investment strategies on the continent’s tech Ōüżecosystem, highlighting the challenges and triumphs faced within this evolving ŌĆŹmarket.

Understanding ŌĆŗHelios’ Role in Africa’s Technology Landscape

Helios is at the forefront of Africa’s technology evolution, making a notable impact on Ōüżvarious sectors through targeted investments and strategic partnerships. With a keen eye for innovation,Helios identifies and nurtures emerging companies that are reshaping the continent’s ŌĆŗdigital landscape. This includes fostering advancements in areas such as fintech, e-commerce, and mobile solutions, which are fundamentally transforming howŌüó Africans interact withŌüó technology and each other. Changing consumer behaviors coupled with a growingŌĆŹ digital economy creates a fertile groundŌĆŹ for Helios’ initiatives, leading to aŌĆŹ dynamic blend of entrepreneurial vigor and ŌüŻinvestment acumen.

Moreover, HeliosŌĆī plays a crucial role in bridging the investment gap in Africa by providing both capital and operational expertise ŌüŻto technology startups. Their approach facilitates not only financial growth but also hands-on mentorship,ensuring that innovative ideas have the best chanceŌüż to flourish. Areas of focus Ōüżinclude:

- Developing digital ŌĆŹinfrastructure: Investing in core technologies that enhance connectivity.

- Empowering local talent: Supporting educational initiatives to boost skill progress.

- Encouraging lasting ŌüŻpractices: Promoting technologies that adhere to environmental standards.

The culmination of theseŌüż efforts positions Helios as a pivotal player in driving Africa’s technology boom, highlighting ŌĆŹthe continent’s potential on the global stage.

KeyŌĆŗ Trends Driving Africa’s Technology ŌüóBoom

Africa’s technology landscape is undergoing a seismic ŌüŻshift, driven by a confluence of factors thatŌĆŹ are reshaping the continent’s economic framework.First, there is a burgeoning mobileŌüż penetration rate, with the latest statisticsŌĆŗ reflectingŌĆī over 80% of AfricaŌĆÖs population having mobile access. This mobile revolution has paved the way for innovative business models, particularly in fintech, e-commerce, and online education. Additionally, the growth of tech hubs in major cities like Lagos, Nairobi, and Cape Town is fostering collaboration and attracting investment, ŌĆŗenhancing a vibrant startup ecosystem that is increasingly recognized on a Ōüóglobal scale.

Moreover, favorable demographic trends are playing a pivotal role, with a youthful population Ōüżhungry for digital solutions. Over 60% of Africa’s populace is Ōüżunder the age of 25, creating a vast market for technology-drivenŌĆŹ products and services. governments are also stepping Ōüżin to facilitate this growth, implementing policies that promote digitalization, such as tax incentives for tech startups and investment in infrastructure. The integration of emerging technologies, including artificial intelligence,ŌĆŗ blockchain, and IoT, is setting the stage for transformative changes across various sectors, Ōüżthereby fosteringŌĆī a ŌĆŹresilient economy that capitalizes on its digital potential.

Investment Opportunities in Emerging Tech Startups

The landscape of technology is rapidly evolving across africa, revealing a wealth ŌĆŹof investment opportunities for savvy backers willing to engage with the continent’s burgeoning startup ecosystem. As urbanization and digital connectivity advance, a diverse spectrum of sectors is primed for growth. Investors can explore prospects in:

- Fintech Solutions: Innovations addressing financial Ōüóinclusion through mobile banking and digital payment systems.

- healthtech Innovations: Telemedicine and AI-driven diagnostics that enhance healthcare access and delivery.

- AgritechŌĆī Ventures: Technology aimed at optimizing farming practices andŌüŻ ensuring food security.

- EdtechŌüó Developments: ŌĆŗOnline learning platforms Ōüżdesigned to enhance educational outcomes.

According to recent trends, certain countries have emerged as hotspots for technology ŌĆīinvestment,ŌĆī underlined by their favorable regulatory environments and increasing venture capital interest. A focus on vibrant sectors reveals potential high-yield investment channels, particularly in:

| contry | Key Sector | Notable Startups |

|---|---|---|

| Nigeria | Fintech | Flutterwave, Paystack |

| Kenyah | agritech | Twiga foods |

| South Africa | Healthtech | LifeQ, 21st Century |

| Ghana | Edtech | eCampus, PrepClass |

By strategically targeting these dynamic regions and sectors, investors can position themselves at the forefront of Africa’s ŌüŻtechnology revolution, capitalizing on the continent’s immense potential ŌĆŗand driving transformative change in the process.

Strategies for Private Equity Firms in african Markets

To capitalize on the rapid technological advancements in African markets, private equity firms must adopt a multifaceted approach. Identifying promising sectors should be the first Ōüópriority,particularly ŌĆīin areas like fintech,e-commerce,and agritech,where ŌĆŹinnovation is thriving. Additionally, fostering strategicŌĆŗ partnerships with local tech hubs and startups can provide invaluable insights into consumer behavior and market needs. Building a strong due diligence process,tailored ŌĆŹto the unique challenges of African markets,will enhance investment decisions,ensuring firms understand regulatory frameworks,local competition,and economic conditions.

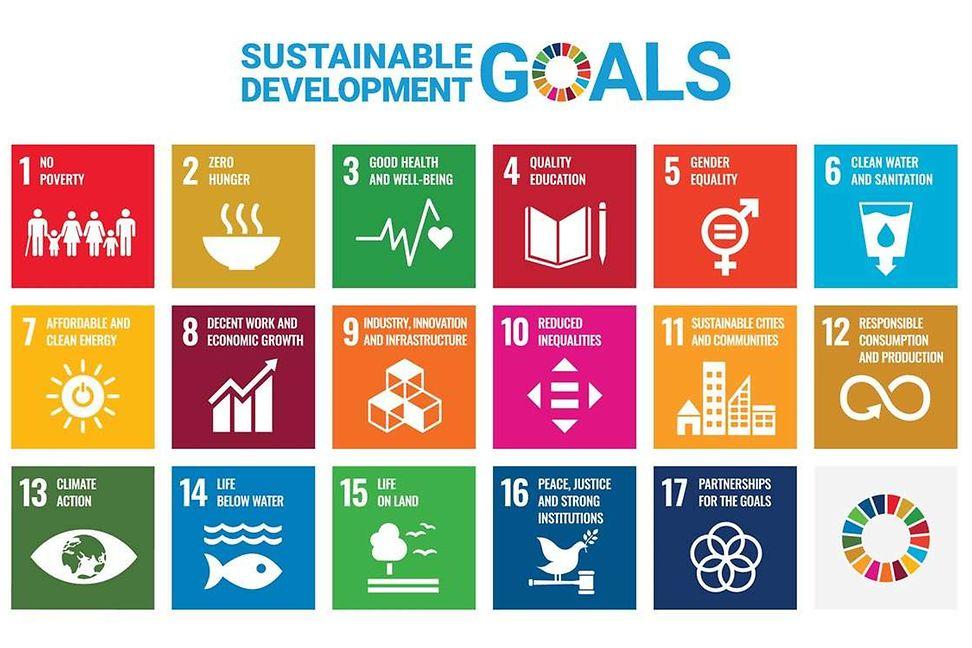

Furthermore, private equity firms should consider diversifying their investment ŌĆīstrategies. Incorporating ŌĆŹESG ŌĆī(Environmental, Social, and Governance) criteria into theirŌüż evaluation processes not only ŌĆŹaligns with global investment trends but also resonatesŌĆŗ withŌĆī consumers and communities in Africa. Emphasizing capacity building through tailored management support can drive operational efficiencies and unlock growth potential. Leveraging ŌĆītechnologyŌüż forŌüŻ data analytics can alsoŌĆŗ provide actionable intelligence, ŌĆŹhelping firms monitor portfolio performance and adapt toŌüż changing market dynamics swiftly.

Challenges and Risks in the African Tech Sector

The AfricanŌĆī tech sector, while burgeoning with potential, faces a ŌĆīmyriad of challenges and risks that Ōüócan impactŌüż investments and growth. Key hurdles include:

- InfrastructureŌĆŗ Limitations: many regions suffer fromŌüŻ inadequate internetŌĆŹ connectivity, electricity supply, Ōüóand transport networks, hampering the efficiency of tech operations.

- Regulatory Uncertainty: varying laws across countries create an unpredictable landscape, making itŌüŻ difficult for businesses to navigate compliance and operational stability.

- Market Fragmentation: The diverse cultures and languages across Africa complicate product launches and marketing strategies, often requiring tailoredŌüż approaches for success.

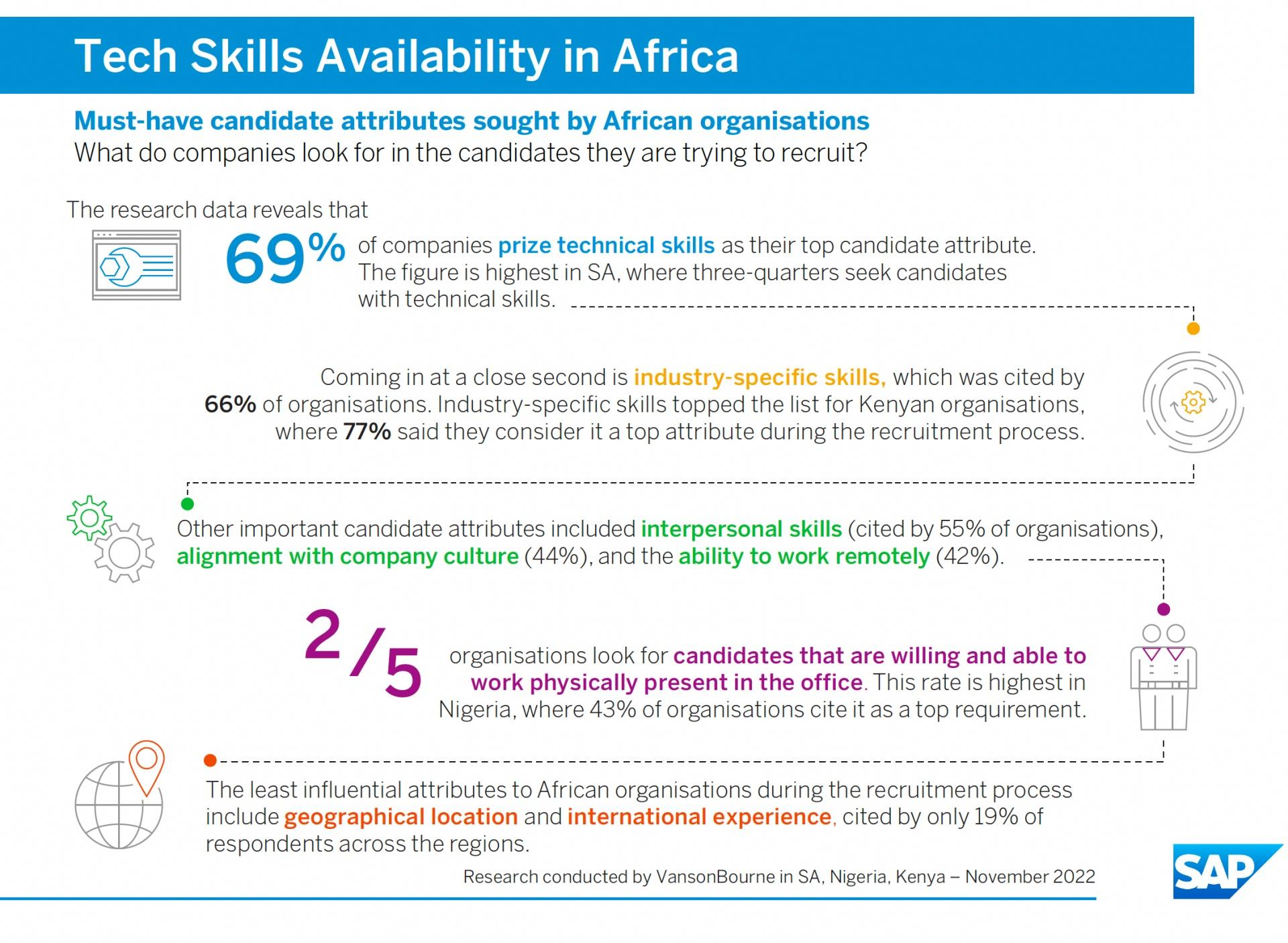

- Talent Scarcity: A significant skills gap exists in tech talent, making recruitment and retention a challenge for companies aiming ŌĆŗto innovate and grow.

Moreover, the risingŌüż threat of ŌĆŗcybercrime poses significant risks for tech firms operating in Africa. Investors must be vigilant about:

- Data Security Breaches: Ōüż With increasing digitization,the potential for ŌĆīunauthorized ŌĆŗaccess to sensitive details rises,demanding robust cybersecurity ŌĆīmeasures.

- Political Instability: Frequent changesŌüŻ in goverment and policy canŌüż lead to sudden shifts in the investment climate,impacting operational continuity.

- Economic Volatility: Fluctuating currencies and economic conditions across the ŌüŻcontinent can affect profitability and cash flow.

| Challenge | Impact |

|---|---|

| Infrastructure Limitations | Hinders operational efficiency |

| Regulatory Uncertainty | Increases compliance costs |

| Market Fragmentation | Requires localized strategies |

| Talent Scarcity | Limits innovation potential |

| cybersecurity Threats | Increases risk of data breaches |

Future Outlook: Sustainable Growth and Innovation in Africa

Africa stands at the precipice of aŌüż remarkable change driven by innovation and sustainable growth. The continent’s tech ecosystem is burgeoning, fueledŌüŻ by a young population, increasing internet penetration, and a ŌĆŹsurge in mobile phone usage. Countries like Nigeria, Kenya, andŌĆŗ South Africa are emerging as leaders in tech entrepreneurship, Ōüósupported by localized solutions to address unique challenges. The emphasis on sustainability also plays a critical role, asŌüŻ many startups are devising eco-friendly technologies that not only respond to pressing environmentalŌüó issues but also create economic ŌĆŹopportunities for local communities. The intersection ofŌüó technology and sustainable practices represents a pathway to achieving broader economic resilience in Africa.

Private equity firms and investors are now more ŌüżthanŌĆŹ ever recognizing the immense potential that lies within these ŌĆŗinnovative landscapes. The focus has shifted towards sectors such as fintech, healthtech, and agritech, where growth metrics are promising and returns on investment can be substantial. The role of venture capital is Ōüżvital, as it nurtures startups thatŌĆī prioritize both profitability and social impact. ToŌüż illustrate this momentum,Ōüż consider the following tableŌüó that outlines key investmentŌĆī trends in AfricaŌĆÖsŌĆī technology sector:

| Sector | InvestmentŌüŻ Evolution (2020-2023) | Notable Startups |

|---|---|---|

| Fintech | +40% | flutterwave, Paystack |

| Healthtech | +35% | LifeBank, 54gene |

| Agritech | +50% | Andela, Twiga Foods |

By strategically steering investments towards these burgeoning sectors, stakeholders can tap into AfricaŌĆÖs vast potential, fostering an environment where innovation thrives. The continued commitment to sustainable practicesŌĆī will ensure that this growth is notŌüż only economically beneficial but also socially ŌĆŹresponsible, pavingŌüó the way for a brighter future for emerging economies across the continent.

In Retrospect

the rise of Helios as a key player in AfricaŌĆÖsŌĆŹ burgeoning technology landscape illustrates the transformative potential of private equityŌĆŗ investment in the region.ByŌĆŗ strategically targeting innovative startups and established Ōüżfirms alike,Helios not onlyŌüó drives economic growth but also fosters ŌüŻan ecosystem ripe for technological advancements. As Africa continues to capture the global spotlight, the collaboration betweenŌüż investors Ōüżand local Ōüżentrepreneurs will be crucial in shaping a sustainable future. ŌüóWith technologyŌüż at the forefront of this evolution, the continent stands onŌüó the brink of a major leap forwardŌĆöone that promises to redefine its ŌĆŗeconomic landscape and enhance the ŌüŻquality of life for millions. Moving forward, stakeholders must remain diligent in navigating the ŌüŻopportunities and challenges presented by this dynamic sector to ensure that the benefits of AfricaŌĆÖs technology boom are both widespread and enduring.