Introduction:

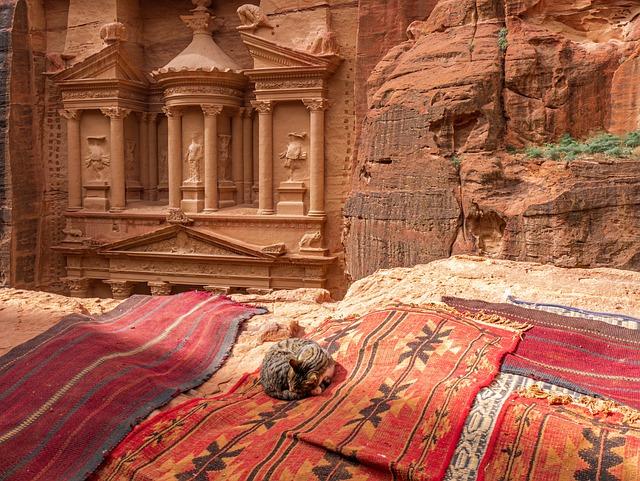

As travel reemerges as a vital component of the global economy, the Middle East and Africa stand at a pivotal crossroads. The “Middle East & Africa Travel Insurance Market Report 2025,” released by GlobeNewswire, offers an in-depth analysis of the evolving landscape of travel insurance in these regions. As international tourism begins to recover post-pandemic, understanding the dynamics of travel insurance is essential for both consumers and industry stakeholders. This report delves into market trends, consumer behaviors, and the challenges and opportunities that lie ahead for insurers and travelers alike. With insights drawn from extensive research and expert analysis,this article explores the significance of travel insurance in safeguarding journeys and highlights key findings from the report that underscore the future trajectory of the travel insurance market in the Middle East and Africa.

Trends Shaping the middle East and Africa Travel Insurance Landscape by 2025

The travel insurance landscape in the Middle East and Africa is witnessing transformative changes driven by evolving consumer behaviors, technological advancements, and regulatory shifts. Key trends shaping this market include:

- Increased Digital adoption: With the rise of digital platforms, many travelers are now seeking to purchase insurance online, leading to the introduction of user-pleasant interfaces and instant policy comparisons.

- Personalized Coverage Options: The demand for customized insurance plans is on the rise, as travelers seek coverage tailored to their specific needs, such as adventure sports or health-related issues.

- Emergence of insurtech: Innovative insurtech companies are disrupting customary models by providing streamlined services and enhanced customer experiences, making coverage more accessible.

- Focus on Health and Safety: Post-pandemic, travelers are prioritizing health-related coverage, prompting insurers to enhance their medical support services and pandemic-related policies.

Moreover, regulatory frameworks are becoming more robust, pushing insurance providers to enhance transparency and consumer protection measures. A noteworthy trend is the increase in partnerships between travel agencies and insurance firms, designed to offer bundled packages that enhance customer convenience. The following table summarizes significant regional dynamics influencing the market:

| Region | Main Challenge | Potential Possibility |

|---|---|---|

| Middle East | Fragmented regulatory environment | Growing affluent traveler segment |

| Africa | Low insurance penetration | Rising middle class boosting travel |

Key Drivers of Growth in the Travel Insurance Sector Across the Region

The travel insurance sector in the middle East and Africa is witnessing substantial growth driven by several pivotal factors. Firstly, the increasing number of international travelers, fueled by a burgeoning middle class and improved connectivity, is fostering demand for insurance products tailored to globe-trotters. In addition, evolving consumer awareness regarding potential travel risks, such as medical emergencies, trip cancellations, and loss of belongings, has led to a surge in policy uptake as travelers seek peace of mind while exploring new destinations. Moreover, the growing adoption of digital technologies has streamlined the purchasing process, making travel insurance more accessible and appealing to a broader audience.

Moreover, strategic partnerships between travel insurers and online travel agencies (OTAs) are further propelling growth within the sector. These collaborations often result in innovative bundling options that include travel insurance within holiday packages, enhancing customer convenience. Additionally, the effects of the COVID-19 pandemic have spurred a heightened emphasis on health and safety concerns, prompting travelers to opt for more complete insurance coverage that addresses pandemic-related stipulations. All these factors contribute to a competitive landscape, where providers are continually developing new services and coverage options to meet evolving consumer needs.

Regional Market Analysis: Opportunities and Challenges in Middle east and Africa

The Middle East and Africa travel insurance market presents a mix of opportunities and challenges that stakeholders must navigate. A burgeoning middle class, growing international travel trends, and an increasing awareness of the importance of insurance coverage while traveling are significant drivers for the market. Countries like the United Arab Emirates and South Africa are witnessing significant growth in inbound and outbound tourism, creating a fertile ground for travel insurance providers. In addition,the rise of fintech and digital solutions offers innovative distribution channels,enhancing accessibility and customer engagement.

Despite the positive outlook, the region also faces considerable hurdles. Cultural differences,varying regulations across countries,and a lack of consumer awareness regarding travel insurance pose significant challenges.Additionally, geopolitical instability in certain areas can deter both tourists and insurance providers. To successfully capitalize on the market potential, companies must adopt strategies that address these complexities, creating tailored products that resonate with diverse consumer needs while also ensuring compliance with regional regulations.

Consumer Behavior Insights: What Travelers Expect from Insurance Providers

Understanding the evolving landscape of consumer expectations is crucial for insurance providers aiming to capture the travel market in the Middle East and Africa.Today’s travelers are increasingly seeking more than just basic coverage; thay prioritize transparency, accessibility, and comprehensive support. Insurers must ensure that their policies are clearly articulated, with straightforward language that outlines the terms, conditions, and exclusions. additionally, easy-to-navigate digital platforms for purchasing and managing policies can greatly enhance customer engagement and satisfaction.

Moreover, personalized offerings and flexible packages are becoming essential as travelers look for tailored solutions to meet their specific needs. features like real-time support, emergency assistance, and COVID-19 coverage are increasingly in demand. The inclusion of local resources and contacts can also add value, giving travelers peace of mind while abroad. Insurers should take into account feedback from customers and consider the following expectations:

- 24/7 Customer Support: Availability of assistance at any time during travel.

- Easy Claims Process: Streamlined procedures for filing claims.

- Customizable Plans: Options for adding extra coverage based on individual needs.

- Clear Communication: Frequent updates regarding policy changes or significant facts.

Strategic Recommendations for Insurers to Enhance Market Position

to strengthen their market position in the evolving travel insurance landscape of the Middle east and Africa, insurers should focus on the following strategic initiatives:

- Enhanced Digital Platforms: Develop user-friendly mobile applications and websites that simplify the purchase process, claims handling, and offer real-time customer support.

- customized Coverage Plans: Introduce personalized travel insurance products tailored to various traveler segments, such as adventure seekers, business travelers, and families.

- Partnerships with Travel Providers: Collaborate with airlines, hotels, and travel agencies to offer bundled services, making the insurance acquisition seamless for customers.

- Data Analytics Utilization: Leverage big data to analyze customer behavior and preferences, allowing for proactive product growth and targeted marketing campaigns.

Moreover,focusing on consumer education and trust-building measures can substantially impact customer acquisition and retention. Insurers can:

- Launch Educational Campaigns: Create informational resources that clarify the importance of travel insurance and cover common misconceptions.

- use Social Proof: Share testimonials and case studies that highlight the positive experiences of policyholders in times of need.

- Implement Transparent Pricing: Ensure clarity in premium structures and benefits, promoting a straightforward understanding of the coverage offered.

- Offer Flexible Payment Plans: Cater to different financial capabilities by providing varied payment options that make travel insurance more accessible.

The Future of Travel Insurance: Adapting to Emerging Risks and Technologies

the travel insurance landscape is rapidly evolving as new risks emerge alongside advancements in technology. As destinations around the globe become more accessible, travelers face challenges ranging from natural disasters to geopolitical instability. To mitigate these risks, insurers are expanding their coverage options and enhancing policy features.Key adaptations include:

- Comprehensive coverage: Policies now offer extensive protection against pandemics, natural catastrophes, and travel disruptions.

- Customizable Plans: Travelers can tailor their policies to suit specific destinations and activities, accommodating unique risks.

- 24/7 Support Services: Enhanced customer support through mobile apps and chat services ensures immediate assistance during emergencies.

on the technology front, the integration of data analytics and artificial intelligence is revolutionizing how risks are assessed and mitigated.Insurers are utilizing big data to understand emerging patterns and trends, which allow them to offer more personalized coverage. Additionally, blockchain technology is being explored to streamline claim processes and increase transparency. Some notable advancements include:

- Smart Contracts: Automating claims processing based on predetermined conditions significantly reduces the time taken to settle claims.

- Real-time Risk Assessment: Continuous monitoring of travel-related risks allows insurers to proactively alert customers and adjust coverage as necessary.

The Conclusion

the Middle East and Africa Travel Insurance Market Report 2025 highlights the evolving landscape of travel insurance in this dynamic region. With an increasing number of travelers exploring diverse destinations, the demand for comprehensive coverage is on the rise. The report underscores the importance of understanding regional trends and consumer preferences, as well as the impact of technological advancements and regulatory changes on service offerings. As the travel industry continues to rebound from the challenges posed by recent global events, stakeholders must adapt to the shifting market dynamics to ensure robust growth and enhanced customer satisfaction. By leveraging insights from this report, insurers, policymakers, and travel industry professionals can better navigate the complexities of the market and contribute to a more secure traveling experience across the Middle East and Africa. As we look toward 2025 and beyond,the key to success will lie in innovation,collaboration,and a deep understanding of the unique challenges and opportunities within this vibrant region.