Kenya and Rwanda Banks Integrate Pan-African Payment System: A Game changer for Economic Connectivity in Africa

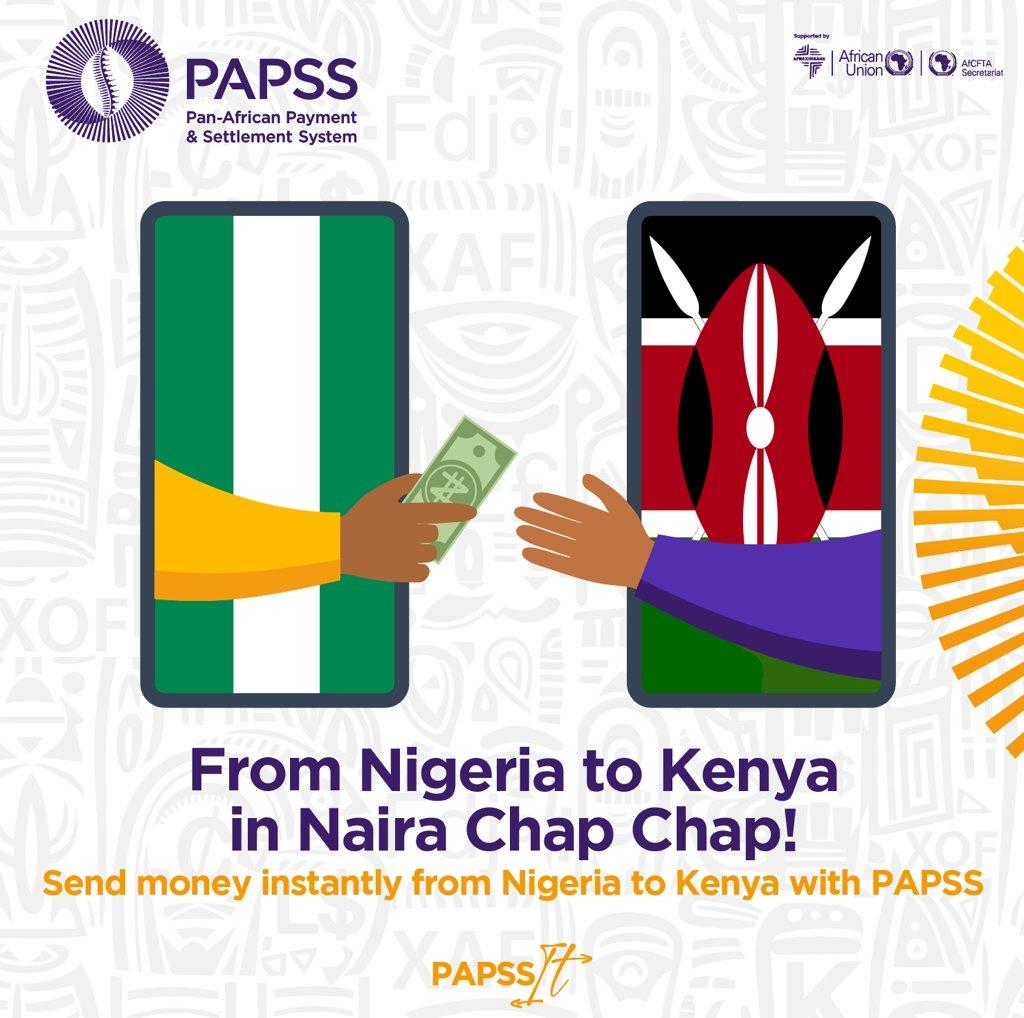

In a notable move towards enhancing financial integration within the continent, banks in Kenya and Rwanda have launched a pan-African payment system designed to streamline cross-border transactions and bolster economic ties.This initiative, dubbed “Connecting Africa,” aims to reduce the barriers faced by businesses and consumers in conducting trade and financial exchanges across borders. As the African Union pushes for a more unified economic landscape through the African Continental Free Trade Area (AfCFTA), this integration marks a pivotal step in facilitating seamless payments and fostering regional cooperation. With the potential to enhance trade efficiency and bolster financial inclusion, the integration of these banking systems could set a precedent for similar collaborations across Africa, highlighting the evolving landscape of financial technology on the continent.

Impact of Pan-African Payment Systems on Regional Trade Dynamics

The integration of a pan-African payment system by banks in Kenya and Rwanda heralds a significant shift in the regional trade landscape. By enabling seamless monetary transactions across borders, this initiative aims to reduce the costs and complexities traditionally associated with intra-African trade. The implications are profound, as businesses can now engage in cross-border commerce with increased efficiency. Key benefits of this system include:

- reduced transaction costs: Lower fees associated with currency exchange and payment processing.

- Speedy transactions: Instant settlements that can enhance cash flow for businesses.

- Increased market access: Smaller enterprises can now compete in larger markets, fostering economic growth.

Moreover, with improved financial interoperability, the collaboration sets the stage for deeper economic integration within the East African Community and beyond. By streamlining payment processes, businesses are encouraged to engage more frequently, leading to an uptick in trade volumes. To better illustrate these dynamics, consider the following table that outlines potential trade growth metrics:

| Metric | Before Integration | Projected After Integration |

|---|---|---|

| Intra-regional Trade Volume (USD Billion) | 2.5 | 5.0 |

| Transaction Time (Days) | 3-5 | 1-2 |

| Cost of Transactions (%) | 5% | 2% |

Technological Innovations Driving Financial Integration in East africa

Recent advancements in technology are reshaping the financial landscape in East Africa, particularly through the integration of a pan-African payment system between banks in Kenya and Rwanda. This initiative aims to streamline cross-border transactions, eliminate challenges related to currency conversion, and enhance overall financial accessibility. Key innovations facilitating this transformation include:

- Mobile Money Platforms: With widespread mobile phone usage, platforms such as M-Pesa and Airtel Money are making it easier for users to conduct financial transactions without traditional banking infrastructure.

- Blockchain Technology: Leveraging blockchain for secure, transparent transactions reduces fraud and cuts costs associated with cross-border payments.

- API Integration: Banks are increasingly adopting Application programming Interfaces (APIs) to facilitate seamless interactions between financial applications, enabling faster and more efficient services.

This collaborative approach fosters not only economic growth but also inclusivity across the regionS diverse population. The impact is further underscored by a notable increase in access to banking services, especially in rural areas where traditional banks are scarce. This is evidenced by the following data on financial inclusion across Kenya and Rwanda:

| Country | Banking Penetration (%) | Registered Mobile Money Users (millions) |

|---|---|---|

| Kenya | 83 | 30 |

| rwanda | 71 | 7.5 |

Challenges Faced by Kenyan and Rwandan Banks in System implementation

Both Kenyan and rwandan banks face a myriad of challenges as they work towards integrating a pan-African payment system. One significant hurdle is the variability in regulatory frameworks. Each country has its own set of regulations that can create confusion and delays during implementation. Key issues include:

- Compliance Costs: Meeting diverse regulatory requirements incurs additional expenses.

- Timelines: Regulations may slow down the integration process, prolonging project timelines.

- Interoperability: Limited standardization of technologies can complicate the integration of systems.

Moreover, banks in these nations must confront technological disparities and infrastructural limitations. The challenges in technology adoption can hinder effective deployment of the new payment systems. Noteworthy issues include:

- Infrastructure Gaps: Inadequate technology infrastructure, especially in rural areas.

- Cybersecurity Risks: Emerging threats necessitate enhanced security measures that can be costly.

- Skill Shortages: A lack of skilled personnel to manage and maintain new systems impacts efficiency.

Regulatory Frameworks Supporting Cross-Border Payment Solutions

The integration of banks in kenya and Rwanda into a pan-African payment system hinges significantly on a robust regulatory framework that fosters collaboration, ensures compliance, and mitigates risk. Both countries have prioritized the harmonization of their financial regulations to facilitate smoother cross-border transactions. This is underpinned by several key initiatives:

- Central Bank Collaboration: The central banks of both nations have engaged in discussions to create unified guidelines that regulate the flow of cross-border payments.

- Microfinance and FinTech Support: Policies encouraging innovation from microfinance and fintech sectors are being developed to empower smaller entities in the ecosystem.

- AML/CFT Compliance: Adoption of Anti-Money Laundering (AML) and Counter Financing of Terrorism (CFT) standards that align with international benchmarks is crucial for building trust.

A supporting legal framework is also vital, which involves the establishment of treaties to facilitate data sharing and interoperability between financial institutions in the region. As seen in recent developments, a collaborative approach helps in addressing challenges such as currency fluctuations and transaction costs. The following table summarizes key regulatory bodies and their roles in promoting effective cross-border payment solutions:

| Regulatory Body | Country | key Function |

|---|---|---|

| Central bank of Kenya | Kenya | Regulates monetary policy and facilitates cross-border payment frameworks. |

| National bank of Rwanda | rwanda | Implements financial regulations and promotes secure payment systems. |

| east African Community | Regional | Oversees regional integration and cooperation in financial services. |

Future Prospects for Financial Collaboration in the African continent

The integration of a pan-African payment system among banks in Kenya and Rwanda signals a transformative shift towards enhanced financial collaboration across the continent. this initiative not only simplifies transactions between nations but also opens doors for abundant opportunities in commerce and trade. By facilitating cross-border payments, it can boost economic growth through the following avenues:

- Increased Trade: Easing payment procedures encourages businesses to expand into neighboring countries.

- Investment Opportunities: Streamlined financial transactions attract both local and foreign investments.

- Financial Inclusion: Improved access to banking services for underserved populations can drive economic growth.

- Technological Innovation: Collaboration breeds advancements in financial technology, fostering a competitive landscape.

as other African nations observe this prosperous model,the potential for regional integration becomes more palpable. The future could see an interconnected financial ecosystem characterized by:

| Key Focus Areas | Potential Benefits |

|---|---|

| Regulatory Harmonization | Minimized barriers, increased investor confidence |

| Currency Integration | Reduced exchange costs, improved stability |

| Digital Payments Expansion | Greater accessibility, enhanced consumer experience |

Such developments could forge partnerships that transcend traditional banking relationships, fostering a collaborative financial landscape that leverages the continent’s diverse resources, talents, and markets. The ripple effects from these initiatives may not be limited to economic growth alone; they could also usher in shared knowledge and innovation, illustrating the power of unity in optimizing Africa’s financial apparatus.

Recommendations for Enhancing User Adoption and System Efficiency

To successfully enhance user adoption and boost system efficiency in the newly integrated pan-African payment system, banks across Kenya and rwanda should prioritize several strategic initiatives. User education plays a critical role in achieving this goal; providing complete training sessions and workshops can facilitate a better understanding of the system’s functionalities. Moreover, leveraging multi-channel support including mobile applications, online tutorials, and in-person assistance can ensure users are well-equipped to navigate the system confidently. Banks should also consider implementing feedback mechanisms to gather user insights, which can drive continuous betterment of the platform.

Furthermore, establishing strategic partnerships with local businesses and community organizations can foster a sense of trust and encourage widespread adoption. by promoting rewards programs that incentivize usage, banks can motivate users to engage more frequently with the system. It is also valuable to integrate performance metrics that monitor transaction times and user satisfaction rates, allowing banks to swiftly address any inefficiencies. In doing so, the financial ecosystems in both countries can not only enhance user experience but also ensure sustainable economic growth across the region.

Key Takeaways

the integration of Kenya and Rwanda’s banking systems into a pan-African payment platform marks a significant stride toward a more interconnected financial landscape across the continent. As these two nations collaborate to streamline cross-border transactions and enhance consumer convenience, they are setting a precedent for other African countries to follow. This initiative not only promises to boost trade and investment but also reinforces the commitment to economic integration within the African Union’s Agenda 2063. As we move towards an increasingly digital and interconnected future, the success of this payment system will be pivotal in fostering economic resilience and innovation throughout Africa. Stakeholders will be watching closely to see how this integration evolves, perhaps paving the way for more collaborative efforts in the African financial sector.