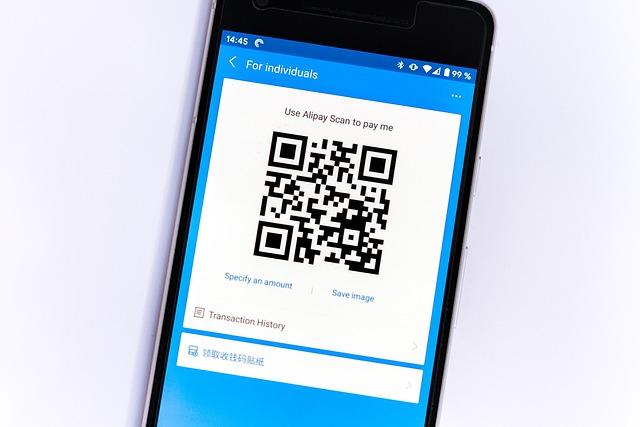

In a strategic move to enhance its foothold in the African e-commerce landscape,AliExpress has announced an expansion of its local payment options,with a particular focus on Egypt. This initiative allows customers in the country to transact in Egyptian Pounds (EGP), a advancement aimed at reducing the barriers to online shopping for millions of consumers. As the demand for online retail continues to surge across the continent, this payment reform not only streamlines the purchasing process but also signifies a broader commitment by AliExpress to cater to the unique financial landscapes of African markets. This article delves into the implications of this development for consumers and businesses alike, exploring how localized payment solutions can drive economic growth and enhance the digital shopping experience in Egypt and beyond.

AliExpress Introduces Local Payment Solutions to Boost E-Commerce in Africa

In a meaningful move to enhance e-commerce capabilities across the African continent, AliExpress has rolled out a range of localized payment solutions tailored to meet the needs of diverse markets. This initiative is particularly highlighted by the introduction of payments in egyptian Pounds (EGP), allowing customers in Egypt to transact seamlessly without the need for currency conversion. By integrating local payment methods, the platform aims to foster a more inclusive shopping experience that caters directly to the preferences and financial practices of African consumers.

The decision to incorporate local currencies and payment options is expected to drive greater engagement and boost sales on the platform. Key benefits of these local solutions include:

- Simplified Transactions: Customers can now perform purchases in thier local currency.

- Enhanced Trust: Local payment methods often engender greater consumer confidence.

- Increased Accessibility: Wider payment options allow more potential buyers to participate in online shopping.

This strategic enhancement aligns with AliExpress’s broader goal of expanding its footprint in Africa, a rapidly growing e-commerce market, thereby positioning itself as a leader in facilitating cross-border trade while catering to local preferences.

Significance of EGP Payments for Egyptian Consumers and Businesses

the introduction of EGP payment options significantly enhances the purchasing power of Egyptian consumers, offering them greater versatility and convenience in online shopping. Local currency transactions eliminate the burden of currency conversion fees and unfavorable exchange rates, allowing consumers to enjoy a more straightforward shopping experience. In addition, the availability of EGP payments caters specifically to the preferences and financial practices of egyptians, making it easier for them to budget and manage their spending on platforms like AliExpress.

For businesses operating in Egypt, this development is equally noteworthy. Accepting EGP payments can lead to an expanded customer base, as local consumers are more likely to make purchases when they see pricing in their native currency.This shift can also foster greater trust and customer loyalty. Businesses can now take advantage of the burgeoning e-commerce landscape without the complexities associated with international transactions, thus streamlining their operations and enhancing their competitive edge in the market.

Impact on Local Economies: Facilitating Access to Global Markets

The introduction of local payment options by platforms like AliExpress is poised to significantly influence local economies across Africa, particularly by opening the gates to international commerce. By allowing payments in the Egyptian Pound (EGP), the expansion not only increases the purchasing power of consumers but also encourages local entrepreneurs to participate in global trade. With easier transactions, local sellers can list their products on international platforms, accessing a broader customer base beyond their immediate geographic confines.

This development enhances the potential for economic growth in several key ways:

- Increased Consumer Access: More individuals can shop online with payment methods they are familiar with, leading to higher spending.

- Empowerment of Small Businesses: Local entrepreneurs gain a foothold in the global market, driving innovation and competition.

- Job Creation: As local businesses thrive, the demand for additional labor increases, impacting employment levels positively.

- Infrastructure Development: A rise in e-commerce may spur improvements in logistics and digital payment infrastructures.

The positive effects are expected to ripple through various sectors of the economy. Market dynamics may shift as local businesses adapt to meet international standards and customer preferences. This proactive response can forge a more resilient economic landscape, where businesses not only compete locally but also gain expertise and visibility on a global scale.

Recommendations for Enhancing consumer awareness and Education

To ensure consumers are well-informed about their options in the expanding e-commerce landscape,it’s crucial to enhance accessibility to educational resources. This can be achieved through various initiatives, such as:

- Workshops and Seminars: Hosting events that focus on navigating online shopping platforms can empower consumers.

- Online Tutorials: Offering video guides and explainer articles on payment methods and security measures can demystify the shopping process.

- Partnering with Local Influencers: Collaborations with trusted voices can help communicate significant information and build credibility.

Furthermore, leveraging technology to develop interactive tools that compare pricing and payment options will allow consumers in regions like Africa to make informed decisions. Initiatives could include:

| Tool | Description |

|---|---|

| Price Comparison Apps | Allow users to see price variations across different platforms instantly. |

| Payment method Evaluators | Help users weigh the pros and cons of different payment options. |

| Security Checklists | provide guidelines to ensure safe online shopping experiences. |

Future Prospects for Digital Payment Adoption across the African Continent

The expansion of local payment options by online platforms such as AliExpress indicates a significant shift towards a more inclusive digital economy in Africa. This move not only facilitates transactions for local consumers but also highlights the increasing integration of e-commerce within the continent. As smartphone penetration rises and internet access improves, we can expect a surge in digital payment adoption across various sectors. Increased consumer confidence in online transactions, facilitated by local payment options like the acceptance of EGP in Egypt, showcases the potential for a robust digital financial ecosystem.

Moreover, the future of digital payments on the African continent will likely be shaped by a combination of factors:

- Mobile Money Growth: Countries with high mobile money usage, such as Kenya, lead the way in digital payment innovation.

- Regulatory Support: Governments are increasingly recognizing the importance of digital payments and are implementing supportive policies.

- financial Inclusion: Efforts to bring unbanked populations into the financial system will spur further adoption of digital payment solutions.

As we look ahead, stakeholders—including fintech companies, policymakers, and traditional banks—must collaborate to create an infrastructure that supports this evolving landscape, ensuring accessible, secure, and diverse payment options for all consumers.

In Conclusion

AliExpress’s recent initiative to expand local payment options in Africa, particularly the introduction of EGP payments in Egypt, marks a significant step forward in enhancing the accessibility of e-commerce for consumers in the region. By catering to local financial practices and preferences, AliExpress not only streamlines the purchasing process for Egyptian shoppers but also fosters greater economic integration within Africa’s burgeoning online marketplace. As more businesses adapt to local currencies and payment systems, it is likely that this move will encourage consumer confidence and stimulate growth in the African e-commerce sector. The ongoing evolution of digital payments across the continent is a promising indication of the future landscape of commerce, as more platforms recognize and respond to the diverse needs of their customers.