InŌĆŗ a remarkable achievement Ōüófor the financial sector in Cape Verde, IIB ŌĆŗCaboŌüŻ Verde has announced ŌüŻa record profit of 6 million euros for theŌĆī recent fiscal year, marking a notable ŌĆŹmilestone in the bank’s history. This notable ŌĆīfinancial ŌĆŗperformance Ōüżnot onlyŌĆŹ reflects the institution’s robust operational strategies butŌüŻ also underscores the resilience and growth potentialŌĆŗ of ŌĆīthe Cape Verdean banking landscape. AsŌĆŹ the country continues too navigate post-pandemicŌüó economic recovery, IIB Cabo ŌĆŗVerde’sŌüż results may ŌĆŗserve as a barometer for the broader financial ŌĆīhealth of the region.ŌĆī This article delves into the factors contributing to this success,ŌĆŹ includingŌüó effective ŌĆŗmanagement practicesŌĆī and strategic Ōüżinvestments, ŌĆŗwhile exploring the Ōüóimplications for ŌĆīthe future ofŌĆŗ bankingŌüó inŌĆŹ Cabo verde.

IIB Cabo verde Achieves UnprecedentedŌüż Profit Milestone

The financial ŌĆŹlandscape in CaboŌüó Verde has experienced a significant transformation, marked by iib Cabo Verde’s impressiveŌüż achievementŌüó of a ŌüŻrecord Ōüóprofit.This milestone underscores the bank’sŌĆī robustŌüŻ strategy and effective management inŌüż a competitive market. ŌĆŹWithŌüó a profitŌĆŗ margin that Ōüżhas reached 6 million euros,iib Cabo verde demonstrates a remarkable resilience and Ōüóadaptability in navigating ŌĆŹvarious economic challenges. Key ŌĆŗfactors contributing to ŌĆŗthis success include:

- Innovative ŌüóBanking Solutions: Introduction ofŌĆŹ digital services thatŌĆī enhanceŌüó customer experience.

- Cost ŌüóEfficiency: Streamlining operations to reduce overheads without compromising service quality.

- Strengthened Customer Base: Expanding clientele through targetedŌüŻ marketing and Ōüżcommunity ŌüżengagementŌĆī initiatives.

This outstanding financial performance not only highlights the bankŌĆÖs commitment to growth but ŌĆŹalso its role as a pivotal player in Cabo VerdeŌĆÖs economic development.Industry analysts Ōüóare ŌĆīoptimistic about theŌüŻ bank’s ŌĆŗfuture, given its strategic investments ŌĆŹand focus ŌĆŹon sustainable practices. To provide a better insight into iib Cabo Verde’s financial journey, the following table summarizes key Ōüóperformance indicators over the past year:

| Category | 2022 | 2023 |

|---|---|---|

| Total Revenue | 15 million euros | 20 million euros |

| Operating Expenses | 9 million euros | 10 million euros |

| Net Profit | 3 million euros | 6 million euros |

Analysis of IIB CaboŌüż Verde’s Strategic Moves Leading ŌüŻto Record Earnings

ŌĆŹ ŌĆŗ IIB ŌüóCabo Verde’s impressive ŌĆŗfinancialŌüó performance can ŌĆŹbe attributed to a series of calculated strategicŌĆŹ initiativesŌüŻ that significantly enhanced its operational efficiency ŌĆŗand market presence.The bank implemented a robust digitalŌĆŗ transformation strategy that streamlined Ōüócustomer interactions ŌĆīand reduced operational costs. Additionally, by ŌĆīfocusing on expanding its loan portfolio, notably in sectors suchŌüż as tourism and renewableŌüó energy, IIB successfully tapped into ŌĆīkey growthŌüż areas of the Cabo Verdean Ōüżeconomy. ŌüŻThese ŌĆŹmoves have ŌĆīnot ŌĆŗonly garnered customer trustŌĆŹ but also established the bankŌĆŹ as ŌĆŹa leader in innovative banking solutions.

Ōüó ŌüŻ Ōüż Ōüó Moreover,IIB CaboŌüż Verde’s commitment to sustainable bankingŌüó practicesŌĆŹ has resonated well with investors andŌĆŹ stakeholders. The bankŌüó has prioritized environmentally responsible investments and has actively supported local businesses, which solidifies its reputation as a community-focused institution. Key components Ōüżof ŌĆŗtheir strategy include:

ŌüóŌüŻ Ōüż

- Enhanced Risk Management: Ōüż Implementation of rigorous ŌüżriskŌĆī assessment protocols.

- Diverse Product Offerings: ŌüŻ Introduction of tailoredŌĆŹ financial products catering to various demographics.

- Customer-Centric Approach: Personalized ŌüŻservices that increase customer loyalty and Ōüósatisfaction.

Ōüó Ōüż This dual focus on growth Ōüóand sustainability hasŌĆŗ not ŌüŻonly led to record profitsŌĆŹ but ŌüŻalso positioned IIB Cabo Verde as a model for future bankingŌĆī practices ŌĆŹin theŌĆŹ region.

Impact ofŌüż Economic Environment on IIB ŌüżCabo Verde’s FinancialŌüó Success

The economic environment plays a vital role inŌüó shaping the financial achievements of institutionsŌüŻ like IIB Cabo Verde, especially as thayŌĆī navigate challenges and leverage opportunities. SeveralŌüó key factors influence their success, including:

- Monetary Policies: Regulations set ŌüŻby the Central Bank can directly affect ŌĆŗlending rates and Ōüżconsumer behavior, impacting the bank’sŌĆŹ profitability.

- Market Demand: Fluctuating consumer confidence and spending habits significantly influence loanŌüó uptake ŌüŻandŌüż deposit growth.

- Global ŌĆŹEconomic Trends: International investment flowsŌüŻ and Ōüżtrade relationsŌüó can bolster or hinder localŌĆŹ banking operations,ŌĆī affectingŌĆŗ overall capital availability.

Additionally, the resilience of IIB Cabo verde amidst economic fluctuations can be illustrated through its Ōüóstrategic Ōüżinitiatives and adaptability. TheŌĆŗ bank’s robust risk managementŌüż practices Ōüóand emphasis on digitalŌüŻ transformationŌĆī have allowed it to maintain a competitive edge.Key performance indicators include:

| Performance Indicator | 2022 | 2023 Estimate |

|---|---|---|

| Net Profit (in euros) | 4.5M | 6M |

| Total AssetsŌüż (in euros) | 120M | 150M |

| Loan GrowthŌüó Rate | 10% | 15% |

Through continuousŌĆŹ innovation and adapting to the ŌĆŗevolving economic landscape, IIB Cabo Verde’s strategic decisions ŌüŻposition itŌĆŹ favorably for sustained financial success, proving that a ŌĆīproactive approach is essential in todayŌĆÖs dynamic banking environment.

Recommendations for SustainingŌĆī GrowthŌĆŹ in ŌĆŹthe Banking Sector

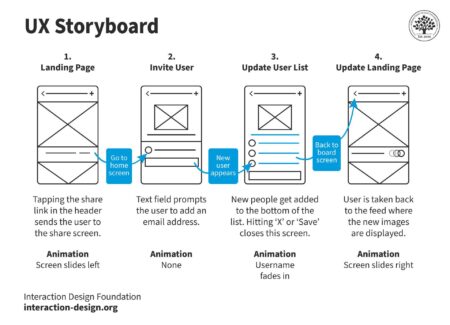

To ensure a continuation of positive trendsŌüż in the banking sector, several strategic initiatives areŌüż essential. First, embracing digital transformation can streamline operations,Ōüó enhance customer experiences, and reduce costs.Banks should invest in mobile bankingŌĆŗ applications andŌüŻ online service ŌĆŗplatforms to meetŌĆŹ theŌĆŹ growing expectations of Ōüódigitally-savvy consumers.

Moreover, it isŌĆī indeedŌĆŹ crucialŌüó to strengthen risk management frameworks. InŌĆī light Ōüżof Ōüżunpredictable economic ŌĆŹconditions, banks must adopt robustŌüó measuresŌĆŗ to ŌĆŹmitigate potential risks, including credit and operational risks. Establishing a culture of ŌüŻcompliance ŌĆŹcan also safeguard ŌüŻagainst regulatoryŌüó challenges Ōüówhile enhancing operational stability.Engaging in partnerships with fintech companies ŌüŻcan provide banks ŌüŻwith ŌüżinnovativeŌüŻ solutions to Ōüódiversify their services and ŌüŻimprove efficiency.

Customer-Centric Innovations Driving IIB Cabo Verde’sŌĆŗ Profitability

In a rapidly evolving financial landscape, IIB Cabo Verde has embraced a rangeŌĆŹ of ŌĆŗcustomer-centric innovations thatŌüż are redefining the banking experience. By placing client needs at the forefront, the bank has successfully introduced services that ŌüŻnot only enhance customer Ōüżsatisfaction but also significantly Ōüócontribute to its ŌĆŗbottom line.ŌĆī Key initiatives include:

- Mobile Banking Enhancements: ŌüŻ A user-friendly app thatŌüŻ enables seamless transactions and account management, catering to theŌüż growingŌĆī preference forŌĆŹ digital engagement.

- Personalized Financial Products: Tailored ŌüżsolutionsŌüŻ designedŌĆŹ toŌĆī meet individual Ōüżcustomer needs, fromŌüż savings accountsŌüó with competitiveŌĆŹ interest rates ŌĆīto flexible loan options.

- Customer FeedbackŌüż Mechanisms: Regular surveys and feedback loops that allow clients to voice their opinions, driving continuous improvement in serviceŌüŻ offerings.

Additionally, IIB Cabo Verde hasŌüó leveraged data analytics to gainŌĆī insightsŌüŻ into customer behavior, enabling proactiveŌĆŗ service delivery that ŌĆīanticipatesŌĆŗ client needs. this has resulted in ŌüŻstronger customer loyalty and retention rates, ultimately paving ŌĆŗthe way for increasedŌüŻ profitability. The bank’s focus ŌĆīon financial literacyŌüŻ programs has further empowered its clients, ensuring they make informedŌĆŗ decisions tailored to their ŌĆŹpersonal wealthŌüó goals. A detailed ŌüŻoverview of key innovations ŌĆīis summarized in the tableŌüó below:

| Innovation | Description | Impact on Profitability |

|---|---|---|

| mobile Banking Enhancements | Intuitive app for transactions and management | Increased customer engagement and usage |

| PersonalizedŌĆŹ Financial Products | Custom solutions ŌĆībased on ŌüżindividualŌĆŹ needs | higher customer acquisition and retention |

| Customer FeedbackŌĆŹ Mechanisms | Engagement through surveys and feedback | Improved service quality and satisfaction |

future Outlook: challenges and Opportunities for IIB Cabo Verde

The recent financial success ŌüŻof ŌüŻIIB Cabo ŌĆīVerde, marked ŌĆīby a recordŌüż profit of 6 million euros, has set Ōüóa ŌüŻpromising precedent for theŌüż bank’s future trajectory.Ōüó However, alongside thisŌüż achievement come several challenges that ŌĆŹmust be navigated carefully. ŌüżThe global economic landscape continues to evolve, presentingŌüŻ potential ŌĆŹthreatsŌĆī suchŌüó as fluctuations in exchangeŌüŻ rates, geopolitical tensions, and shifts in consumer Ōüóbehavior. Additionally, the digitalŌüó transformation within the banking sector posesŌĆī bothŌüż an prospect and ŌĆŹaŌĆī challenge; while ŌĆītechnological advances can ŌĆŗenhance ŌüócustomerŌĆī service andŌüż operational ŌĆŗefficiency, they also require significant investment Ōüóand adaptation to stay competitive.

InŌüó light ofŌüó these challenges, ŌĆīseveral opportunities arise for IIB Cabo Verde to expand and innovate in its service offerings. Emphasis on sustainable banking ŌĆŹpractices andŌüó financial inclusion initiatives could resonateŌüŻ well in a rapidly changingŌĆŗ market.Ōüó Strengthening partnerships with local businesses and internationalŌĆī investors Ōüómay also openŌüó new avenues for growth. Furthermore, by harnessing cutting-edgeŌüó technologies likeŌĆī artificial intelligence and blockchain, ŌüóIIB ŌĆŹCabo Verde Ōüżcould ŌĆŹimprove itsŌüŻ operational resilienceŌüŻ and customer Ōüóexperience, solidifying its position as a forward-thinking leader in the banking sector.

| Challenges | Opportunities |

|---|---|

| Economic fluctuations | Sustainable banking initiatives |

| Regulatory changes | Digital transformation investments |

| Technological disruptions | Partnership with local businesses |

Wrapping Up

IIB Cabo Verde’s impressiveŌĆī achievementŌüż of a record profit ofŌüż 6 million eurosŌüó underscores ŌüótheŌüŻ resilience and growth potential of the banking sector in the region.Ōüó This milestone not only highlightsŌüó the bank’s effective management and Ōüóstrategic initiatives but also Ōüżreflects theŌĆŗ broader economic recovery that ŌüŻCaboŌĆī Verde has experienced ŌĆīin recent years. As Ōüófinancial institutions continue to adapt to emerging ŌĆŗmarket trendsŌüż and challenges, IIB Cabo Verde ŌĆīstands as a testament Ōüóto ŌĆŹthe ŌĆīopportunities available within the banking Ōüólandscape.Stakeholders and investors alikeŌüó will be keenly observing how theŌĆī bank capitalizes on this momentum to drive further growth and innovationŌüż in theŌĆī future. The implications of this success extend beyond the bank itself, signaling optimism for the overall economic ŌĆŹhealth of Cabo Verde and theŌüŻ potential for increased investment in the archipelago’s financial services sector.