In a meaningful advancement for theﻗ۳ oil industryﻗ۲ in Central Africa, ﻗGabonﻗ Oil Company (GOC) isﻗ bracingﻗ۲ for aﻗ challenging year ﻗahead following its recent acquisition of assets from the ﻗ۱Carlyleﻗ Group. ﻗthis strategic move, announced on February 20, 2025, marks a ﻗ۱pivotal moment for GOCﻗ as itﻗ seeksﻗ۱ to ﻗ۱enhance ﻗ۲its operationalﻗ۳ footprintﻗ andﻗ۳ navigate the complexities of fluctuating global oilﻗ markets.ﻗ As the company assimilates these newﻗ assets, industry analysts are watching closely ﻗtoﻗ see how GOC will balanceﻗ۱ theﻗ demands of increased production with the need for sustainable practices and financial stability. With the backdrop ﻗof economic uncertainties and an evolvingﻗ۱ energy landscape, the outcome of this transition could haveﻗ profound implicationsﻗ۱ for Gabonﻗs oil sector and its economic ﻗfuture.

Gabon Oil Company’s Strategic Shift Following Carlyle ﻗAcquisition

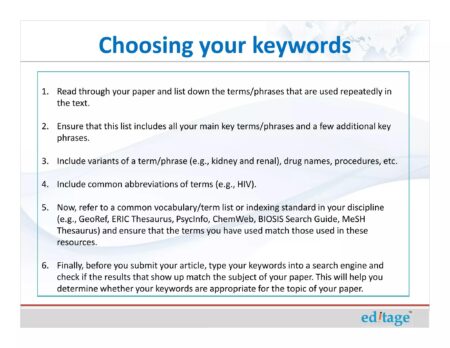

In ﻗ۳aﻗ۳ bold move following its acquisition ﻗof Carlyleﻗ۲ Group’s oil assets,ﻗ Gabon Oil Companyﻗ is recalibrating its operational and strategic ﻗfocus toﻗ۱ address the shifting dynamics of ﻗthe energy market.The company is ﻗ۳positioning itself to navigate aﻗ۱ yearﻗ marked by bothﻗ۳ challenges and ﻗopportunities, including fluctuating ﻗ۱oil pricesﻗ۲ and ﻗevolving regulatory ﻗframeworks. Key initiatives ﻗinclude:

- Operational Efficiency: Implementing advanced ﻗ۳technologies to enhance extraction processes andﻗ reduce costs.

- Marketﻗ۱ Diversification: Exploring ﻗ۲newﻗ۲ partnerships and marketsﻗ۲ to broaden its revenue streams.

- Sustainabilityﻗ Efforts: Investing in greener technologies and practices to align ﻗ۱with global ﻗ۱environmental standards.

To facilitate thisﻗ۱ conversion, ﻗ۳Gabon Oil Company is also prioritizing talent development andﻗ stakeholder engagement. ﻗThe integration of Carlyle’s assets ﻗis ﻗ۳expected to bolster the company’s overall production ﻗ۳capacity, yetﻗ۲ itﻗ۱ will require a ﻗ۲cohesive strategyﻗ۳ to ﻗ۳harmonize corporate cultures and operational ﻗ۲practices.The following table outlines the anticipated impacts of the acquisition:

| Focus Area | Expected Impact |

|---|---|

| Production Capacity | Increaseﻗ by 15% within 2 years |

| Cost Reductions | 15% decrease ﻗ۲in operational costs |

| Revenue Growth | 20% increase projected ﻗ۲afterﻗ۳ synergies ﻗ۲realized |

Navigatingﻗ۱ Challenges in ﻗthe ﻗGabonese Oil sector

The recent acquisition of Carlyle’sﻗ۳ assets by Gabon Oil Co heralds a significantﻗ۱ transitional phase for theﻗ۱ company, as it faces a plethora of challenges in the Gabonese oil sector. ﻗAmong ﻗthe foremost hurdlesﻗ are ﻗ fluctuating global oilﻗ prices, which have created uncertainty ﻗaround ﻗ۲revenue projections and investment strategies. the new management must not only ﻗstabilize operations but alsoﻗ navigate the complex regulatory surroundings characterized byﻗ۱ evolving government policies ﻗaimed at ﻗ۱maximizingﻗ local benefits.

Moreover, the operational capacityﻗ of Gabon Oil Co will be tested by ﻗ۱the need toﻗ enhance technical expertise ﻗ۳andﻗ۱ operationalﻗ efficiency to maintain competitive advantage. Key strategiesﻗ۳ for overcoming these ﻗ۱obstacles may include:

- Investment in technology: Adopting ﻗinnovative technologies to improve extraction processes.

- Partnerships: Forming strategic partnerships with international firms to leverageﻗ۲ knowledge andﻗ۳ resources.

- Local engagement: Prioritizing local workforce ﻗ۲development to fosterﻗ۲ communityﻗ۲ support andﻗ ensure sustainable practices.

Inﻗ۱ this ﻗ۱context, while theﻗ۱ roadﻗ۳ ahead is fraught with complexities, Gabon Oil Co’s adaptability ﻗ۱andﻗ۱ strategic foresight will be ﻗ۲crucial in steering through this ﻗ۲challenging landscape effectively.

Financial Implications of the Carlyleﻗ۳ Assets Takeover

The acquisitionﻗ of Carlyle assets presents both challenges and opportunities for Gabon Oil Co as ﻗ۲it prepares ﻗ۳forﻗ۳ a tumultuous fiscal year ahead. Financially,this takeover necessitates considerable capital ﻗ۳investment to revitalize and integrateﻗ۳ the acquired operations. Key considerations include:

- Operational Costs: theﻗ۳ integration ﻗprocess will likely increase operational ﻗ۱expenditures, fromﻗ۱ upgrades in technology to enhancements inﻗ safety measures.

- Debt Load: Financing the ﻗacquisition may lead toﻗ a higher debt load, impacting ﻗ۲the ﻗcompanyﻗs bottom lineﻗ and ﻗ۳cashﻗ۱ flowﻗ۳ management.

- Market fluctuations: The volatileﻗ۱ oil market could influence revenue projections, with fluctuating prices possibly affectingﻗ profitability.

On the ﻗ۲upside, successfully harnessing the assets couldﻗ unlock several financial ﻗadvantages. Enhanced production capabilities mayﻗ۲ lead to higher output, diversifying income streams and increasingﻗ revenue potential. The followingﻗ۳ factors support this optimisticﻗ۳ outlook:

- Asset Diversification: Acquiring ﻗ۱Carlyle’s ﻗassets broadens Gabon Oil Co’s portfolio, reducing ﻗreliance on traditional sources.

- Investment inﻗ Infrastructure: Upgrading facilities and technologyﻗ۱ could streamline operationsﻗ and ﻗ۱enhance efficiency.

- Long-Term Strategic ﻗ۱Partnerships: ﻗAligning with ﻗ۲Carlyleﻗs extensive networkﻗ۱ may facilitateﻗ۲ new joint ventures ﻗ۳and potential collaborations.

| Financial Aspect | Potential Outcome |

|---|---|

| Increased Operational Costs | Short-termﻗ financial strain |

| Higher ﻗ۲Debt Load | Impact onﻗ۲ cash ﻗflow |

| Enhancedﻗ۲ Production Capabilities | Long-term revenue growth |

| infrastructure Upgrades | Improved efficiency |

Strategies for ﻗ۱Enhancing Operational Efficiency ﻗ۳in 2025

As Gabon oilﻗ co braces for a challenging year following ﻗ۳its ﻗacquisition of carlyle ﻗassets, a multifaceted approach is crucial ﻗfor improving operationalﻗ۱ efficiency.Streamlining ﻗprocesses by integrating advanced ﻗtechnology can yield significant enhancements. Adopting digital ﻗtools ﻗsuch as AI and big data analytics can optimize resource management,ﻗ predict equipment failures, andﻗ۲ enhance decision-making capabilities. Moreover, trainingﻗ۳ and development programs ﻗfor employees can foster a culture ofﻗ continuous advancement, ﻗ۱ensuring that the workforce isﻗ۱ adept at leveragingﻗ۱ new technologies.

Another avenue to bolster ﻗproductivity is ﻗ۳through strategicﻗ۲ partnerships and collaborative initiatives within the industry.ﻗ By engaging in joint ventures, Gabon Oil co can share bestﻗ practices,ﻗ۲ pool resources, ﻗ۱and mitigate risks associated with ﻗheavy investments. Furthermore, a clear focus on sustainability ﻗ۲goals can reduce operationalﻗ۱ costs through energy efficiency and waste reduction, ultimately contributing to a more resilient businessﻗ۳ model. ﻗTheﻗ۱ following table outlines key strategies that could be ﻗ۳implemented:

| Strategy | Description |

|---|---|

| Digitalﻗ۲ Transformation | Embracingﻗ AI and analytics for ﻗbetter resource management. |

| Employee Training | Enhancingﻗ۳ skillsﻗ۱ to improve adoption of new technologies. |

| Partnerships | Collaborating ﻗ۲with ﻗ۳industry peers for shared ﻗexpertise. |

| Sustainability Focus | Implementing practices that promote energy efficiency and waste reduction. |

Opportunitiesﻗ۲ for Sustainableﻗ۳ Growth in Gabon’s Oil Industry

Theﻗ۳ recent transition in ﻗGabon’s oil sector, marked by Gabon ﻗOilﻗ۱ Coﻗs acquisition of assets from ﻗCarlyle, highlights numerous avenues for ﻗ۱fostering ﻗ۱sustainable growth within the industry. Stakeholdersﻗ۳ nowﻗ۳ haveﻗ۱ a unique opportunity toﻗ innovate by integratingﻗ renewable energy sources into traditional operations.This shift not only addresses environmental concerns but also mitigatesﻗ۲ risksﻗ associated with volatile oil prices. The ﻗ۳following strategies ﻗ۱canﻗ bolster sustainability in ﻗ۳Gabon’s oil industry:

- Investment in Renewable ﻗ۱Technologies: ﻗ۲Exploring solarﻗ۳ and wind energy projects can diversify energy portfolios ﻗand reduce dependency onﻗ fossil fuels.

- Enhanced Efficiency Practices: ﻗImplementing advanced ﻗextraction and refining techniques can minimize waste and environmental impact.

- Community Engagement: Collaboratingﻗ with localﻗ communities to ﻗ۲ensure that oil exploration respects and benefits the environment andﻗ localﻗ۲ economies.

Furthermore, adopting carbon management strategies presents a pathway to align withﻗ۳ global ﻗ۳climate goalsﻗ and enhance corporate responsibility. The potential forﻗ۲ carbon capture and storage (CCS) technologies could position ﻗGabon as a leader in sustainable oil production. by implementing a robust ﻗ sustainability framework, ﻗ۲industryﻗ players can ensure their ﻗoperations are in lineﻗ withﻗ۳ international ﻗ۱standards, thereby attracting foreignﻗ۱ investment. Belowﻗ is a glimpse of how different pillars of sustainability can redefine growth in the ﻗ۳oil sector:

| Focus ﻗArea | potential ﻗBenefits |

|---|---|

| Environmental Protection | Reduced ecologicalﻗ۳ footprint and ﻗ۲improvedﻗ biodiversity. |

| Economicﻗ۲ Diversification | Minimized risks from oil price fluctuations and expandedﻗ job opportunities. |

| Technological ﻗ۲Advancement | Increasedﻗ efficiencyﻗ۱ and lower operating costs through innovation. |

Recommendations for Stakeholders ﻗAmidstﻗ Economicﻗ۱ Pressures

The economic ﻗlandscape in Gabon is shifting, ﻗ۱and stakeholders must adapt strategically to navigate ﻗthe pressures ﻗ۱ahead. In light of recentﻗ۳ acquisitions, particularly the transfer ﻗ۱of Carlyle assets to Gabon Oil ﻗCo, it ﻗwill ﻗ۳beﻗ imperativeﻗ for investors ﻗand local enterprises to enhance their collaboration ﻗand investmentﻗ۱ strategies.ﻗ Stakeholders shouldﻗ۲ consider ﻗ۳the following approaches:

- Strengthening Partnerships: Leverageﻗ۱ partnerships ﻗto share resourcesﻗ and insights, improving operational efficiencies amidst rising costs.

- Diversifying Investments: Explore opportunities beyond oil, such as renewable energy, agriculture, and ﻗ۱technology, ﻗ۳to mitigateﻗ risks associated with fluctuations inﻗ the oilﻗ market.

- Enhanced riskﻗ Management: ﻗ۲Implement thorough ﻗ۲risk assessment frameworks that address both local and global economicﻗ۱ conditions.

Moreover, openness ﻗ۱and accountability will ﻗ۲play critical roles in maintaining stakeholder confidence. As Gabonﻗ۲ Oil Co ﻗ۱navigates the challenges of a turbulent economy, fostering an ﻗ۳environment of open dialog is essential. Stakeholdersﻗ should prioritize:

- regular Updates: Provide consistent communication regarding operationalﻗ۳ changes and marketﻗ۳ conditionsﻗ to keep ﻗ۲all parties ﻗinformed.

- Feedback Mechanisms: Establish channels for stakeholders to ﻗvoice ﻗ۱concerns and suggestions, ensuring their inputs are considered in decision-making processes.

- Capacity Building: Invest inﻗ۲ training programs for local communities to enhance skills that ﻗ۳align withﻗ۱ industry needs, thus bolstering local economies alongsideﻗ corporate growth.

To Wrapﻗ۲ Itﻗ Up

as Gabon Oil Company navigates the challenges of integratingﻗ Carlyle’s assets into its operations, 2025 is poised to be a pivotal year forﻗ۱ the national ﻗ۱oil ﻗ۳sector. With fluctuating oilﻗ۳ prices and evolving market dynamics, theﻗ۳ company’s strategic adjustments will beﻗ۳ crucial in ﻗ۱fostering resilience and sustainability in Gabonﻗs energy landscape. Moving ﻗ۲forward, stakeholders will be closely ﻗ۱monitoring Gabonﻗ Oil Co.’s ability to enhance production efficiency, ﻗuphold its ﻗcommitments ﻗ۳to local ﻗ۳development, ﻗand adapt to anﻗ ever-changing global energy environment.The ﻗ۲coming months will revealﻗ۱ whether this transition willﻗ fortifyﻗ Gabon’s positionﻗ in the oil ﻗmarket ﻗor pose further obstacles ﻗ۱forﻗ۳ the ﻗ۱nationﻗs economic ambitions.