In a notable revelation regarding Egypt’s pivotal economic artery, President Abdel Fattah el-Sisi has disclosed that the Suez Canal, a vital conduit for global maritime trade, is currently facing monthly revenue losses estimated at around $800 million. This proclamation highlights the challenging landscape for one of the world’s most significant shipping routes, which has historically contributed substantially too Egypt’s national income. The Suez Canal’s financial strains are indicative of broader economic pressures facing the nation, exacerbated by global supply chain disruptions and regional geopolitical tensions. as egypt navigates these turbulent waters,the implications of diminished canal revenues extend beyond national borders,affecting international trade dynamics and economic stability in the region.This article delves into the factors contributing to the Suez Canal’s revenue decline and the potential repercussions for Egypt’s economy and its role in global commerce.

Egypt Experiences Significant revenue Losses from Suez Canal According to Presidential Statements

In a recent announcement, President Abdel Fattah el-Sisi highlighted the substantial financial impact facing Egypt due to declining revenues from the Suez Canal. Monthly losses are estimated at approximately $800 million, a staggering figure that underscores the critical role this maritime artery plays in the nation’s economy. The canal has historically been a significant source of income, contributing to crucial foreign reserves.However, various factors, including global trade fluctuations and increased competition from choice shipping routes, have contributed to this alarming decline in revenue.

To further illustrate the magnitude of these losses, consider the following key points:

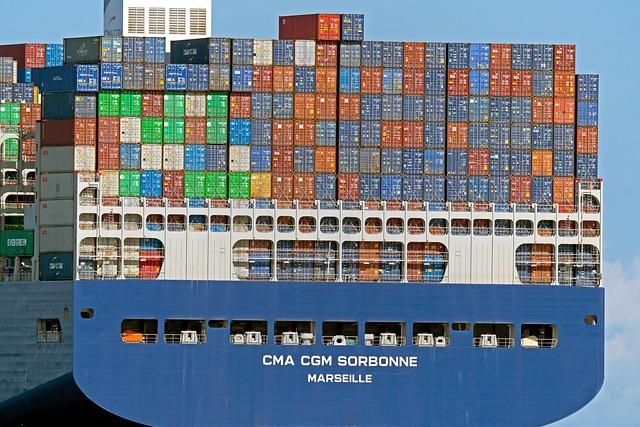

- Strategic Importance: The Suez Canal connects Europe to asia, making it one of the most vital trade routes globally.

- Impact on Trade: Disruptions in global supply chains have diminished traffic through the canal.

- Future Investments: The Egyptian government is exploring strategies to boost efficiency and attract more shipping traffic.

| Month | Estimated Revenue Loss ($ millions) |

|---|---|

| January | 800 |

| february | 800 |

| March | 800 |

Economic Impact of Suez Canal Revenue Decline on Egypt’s National Budget

The decline in revenue from the Suez Canal, a vital artery for global trade and a significant contributor to Egypt’s national budget, poses serious challenges for the country’s economy. With reported losses approximating $800 million monthly,this downturn affects government income,making it increasingly tough to fund essential services and infrastructure projects. The Suez canal Authority’s financial struggles can be attributed to several factors including shifts in global shipping routes, increased competition from alternative passages, and the lingering effects of geopolitical tensions that have derailed trade volumes.

As Egypt grapples with this financial setback, the implications extend beyond mere numbers. Economic stability may be jeopardized, prompting potential measures such as cuts in public spending or increased borrowing.The impact of sustained revenue shortfalls could manifest in various ways, including:

- Reduced funding for social programs

- Increased inflation due to economic stress

- Strain on foreign exchange reserves

- Potential delays in infrastructure development

To further illustrate the economic ramifications, the following table outlines projected revenue impacts over the next few quarters:

| Quarter | Projected Revenue Loss (in Million $) |

|---|---|

| Q1 | 2400 |

| Q2 | 2400 |

| Q3 | 2400 |

| Q4 | 2400 |

Factors Contributing to the Decline in Suez Canal Traffic and Revenue

The decline in traffic through the Suez Canal,leading to significant monthly revenue losses,can be attributed to a variety of interlinked factors. Global supply chain disruptions, particularly in the wake of the pandemic, have shifted trade patterns, causing fluctuations in shipping routes and schedules. Additionally, the ongoing tensions in various international markets have resulted in increased geopolitical risks, prompting shipping companies to reconsider their reliance on traditional routes. Othre contributing elements include:

- Environmental Regulations: Stricter environmental policies are requiring shipping companies to invest in cleaner technologies, leading to potential delays and increased operational costs.

- Alternatives in Maritime Routes: Emerging alternatives like the Northern Sea Route have piqued interest, particularly as climate change reduces ice, providing a feasible detour around the traditional Suez route.

- Economic Factors: High fuel prices and global inflation have strained logistics budgets, causing some companies to scale back and prefer slower, more cost-effective shipping methods.

Moreover, the competitive landscape for shipping services has intensified, with other canals and shipping lanes vying for traffic.The pandemic has accelerated shifts toward larger vessels, which, while increasing capacity, complicate navigation and logistics in traditional areas like the Suez Canal.the following table outlines the recent trends affecting Suez Canal traffic:

| Factor | Impact on traffic | Revenue implication |

|---|---|---|

| Global Supply Chain Disruptions | Reduced shipping frequency | Loss of $200 million/month |

| Emerging Alternative Routes | Diverted shipping traffic | Loss of $300 million/month |

| higher Operational Costs | Delay in transit times | loss of $300 million/month |

strategic Recommendations for Boosting Suez Canal Revenue Amidst Increasing Challenges

To enhance revenue generation from the Suez Canal, several strategic initiatives can be implemented, taking into account the evolving maritime landscape and the rising costs burdening shipping lines. First, adopting a tiered pricing structure based on the size and type of vessels could attract more traffic while optimizing income. Incentives for operators who choose eco-kind routes or vessels could be introduced to align with global sustainability trends, helping the canal stand out as a premier green shipping corridor. Additionally, improving the infrastructure and technology used for navigation and freight management within the canal could reduce transit times and improve the overall experiance for shipping companies.

Another avenue to bolster revenue could involve diversifying services offered within the Suez Canal’s operational zone. By developing logistics hubs that provide warehousing, maintenance, and repair services, Egypt can entice shipping companies to consider the canal as a full-service route rather than a mere passageway. Incorporating value-added services such as customs facilitation and expedited cargo clearance can diminish waiting times and encourage larger volumes of shipping traffic. Together, these measures could create a robust economic ecosystem, ensuring stable income flows even amidst a fluctuating global maritime market.

Potential Long-Term Consequences of Sustained Revenue Losses for Egypt’s Economy

The sustained revenue losses from the Suez Canal could have far-reaching implications for Egypt’s economy. As one of the nation’s primary sources of foreign currency, a consistent shortfall of around $800 million per month not only constrains public finances but also raises concerns regarding investments in infrastructure and social services. Potential long-term impacts include:

- Increased national Debt: A decline in revenue may force the government to borrow more, leading to a precarious fiscal situation.

- Reduced Public Spending: With less income, the government may cut back on essential services, which could result in deteriorating healthcare and education systems.

- Currency Devaluation: Prolonged losses might impact the value of the Egyptian pound, making imports more expensive and driving inflation.

Moreover, the economic repercussions of consistent revenue reductions are likely to deter foreign investment, as confidence in Egypt’s economic stability wanes. Potential fallout includes:

- Stagnant economic Growth: A drop in foreign direct investment can stymie growth and innovation, perpetuating economic stagnation.

- Unemployment Rates on the Rise: Job creation initiatives may stall, resulting in higher unemployment and social unrest.

- Destabilization of Key Sectors: critical industries, particularly tourism and shipping, may suffer long-term setbacks due to reduced economic activity.

| Potential consequence | Impact |

|---|---|

| Increased National Debt | Higher borrowing costs, possible economic instability |

| Reduced Public Spending | Deterioration of healthcare and education |

| Currency Devaluation | Inflation and higher cost of living |

Global Shipping Trends and Their Influence on the Future of the Suez Canal Revenue

The landscape of global shipping has undergone significant changes in recent years, influenced by various factors such as evolving trade patterns and advancements in maritime technology. As global supply chains adapt, shipping routes are being optimized for efficiency, which has direct implications for key points of transit like the Suez Canal. The rise of mega-ships capable of transporting large volumes of cargo means that ports and canals must cater to larger vessels,necessitating infrastructural enhancements and navigation system upgrades. Consequently, a shift in demand toward alternate routes could impact the reliance on traditional passageways, placing added pressure on the Suez Canal’s revenue streams.

Moreover, geopolitical tensions and environmental regulations are reshaping the dynamics of international trade. Factors like the implementation of stricter emissions standards and the ongoing shift toward sustainable shipping alternatives are prompting shipping companies to re-evaluate their operational strategies. key considerations influencing this trend include:

- Increased Focus on Sustainability: Shipping companies are investing in greener technologies, which may affect routes to minimize emissions.

- Trade Agreements and Tariffs: changing trade policies can shift cargo flows and impact Suez Canal usage.

- Port Development in Competing Regions: Rival canals and shipping lanes are emerging, potentially diverting traffic away from the Suez.

This confluence of trends may challenge the Suez Canal’s ancient dominance but also presents opportunities for adaptation and enhancement of services to secure future revenue.By investing in modernization and efficiency, the Suez Canal can maintain its pivotal role in global trade, even amidst evolving shipping landscapes.

The Conclusion

the financial repercussions of the suez Canal’s reduced traffic have become increasingly evident, with President Abdel Fattah el-Sisi revealing monthly revenue losses that approximate $800 million.The canal, a vital artery for global trade, has faced challenges ranging from geopolitical tensions to shifts in shipping routes. As Egypt navigates these turbulent waters, the government’s emphasis on enhancing infrastructure and exploring alternative revenue streams will be crucial. The situation remains dynamic, and stakeholders will be closely monitoring developments in the region as Egypt seeks to regain its economic footing amid these substantial losses. Continued attention to the Suez Canal’s operational status will be essential in assessing not only the local economy but also the broader impacts on international trade.