In a recent statement, Egyptian Prime Minister mostafa Madbouly has addressed ongoing speculation regarding the potential sale of Banque du Caire, one of the contry’s leading banks. The remarks, which aim to quell concerns among stakeholders and the general public, highlight the government’s commitment to maintaining stability in the financial sector amid a backdrop of fluctuating economic conditions. as the government evaluates its fiscal strategies and plans for privatization, madbouly’s denial underscores the complexities and sensitivities of the banking landscape in Egypt. This article delves into the implications of these rumors, the strategic importance of Banque du Caire, and the broader context of Egypt’s economic reforms.

Madbouly Addresses resale Speculations Concerning Banque du Caire

Prime Minister Mostafa Madbouly has unequivocally dismissed recent rumors regarding the potential sale of Banque du Caire, asserting that there are no ongoing negotiations or intentions to privatize the bank. During a press conference,Madbouly emphasized the government’s commitment to maintaining control over this significant financial institution,which plays a vital role in Egypt’s banking sector and economic landscape.The Prime Minister underscored that such speculation could lead to uncertainty among investors and stakeholders, and he urged the public to disregard these unfounded claims.

to provide clarity on the government’s position, Madbouly outlined key points regarding the bank’s stability and strategic importance:

- National Asset: Banque du Caire is considered a crucial asset within Egypt’s financial system.

- Economic Contribution: the bank significantly contributes to the national economy through its various services and products.

- Continued Investment: The government plans ongoing investment in the bank to enhance its capabilities and services.

This statement from the Prime Minister aims to instill confidence among the public and investors alike, reinforcing that Banque du Caire remains a state-owned entity dedicated to supporting Egypt’s economic development.

Implications of the Denial on Egypt’s Banking Sector Stability

The recent denial by Prime minister Mostafa Madbouly regarding the rumored sale of Banque du Caire has stirred a mix of reassurance and skepticism within Egypt’s financial community. This declaration comes at a critical time when the stability of the banking sector is under scrutiny, especially amidst fluctuating economic indicators and global financial uncertainties. A successful sale could have perhaps injected much-needed capital into the market, but rather, the denial raises questions about the government’s plan to bolster the banking sector’s resilience and address ongoing liquidity challenges.

Key considerations in assessing the implications of this denial include:

- Market Sentiment: The clarity provided by governmental statements can influence investor confidence, which is crucial for maintaining stability in the banking sector.

- Regulatory Framework: The government’s stance may reflect its commitment to reinforcing regulatory measures rather than privatization as a means of strengthening financial institutions.

- long-term Strategy: This incident could signal a strategic pivot towards greater state control, potentially impacting future investment attractiveness within the banking sector.

Moving forward, it is indeed essential to monitor the government’s actions closely, particularly in relation to economic reforms and support measures for banks. An effective alignment of government policy with market needs will be critical in ensuring a robust banking surroundings capable of withstanding both domestic and global pressures. Stakeholders will be keen to see whether this denial will lead to more clear communication concerning financial strategies and a clearer roadmap for the future of Egypt’s banking landscape.

Analyzing the Role of Banque du Caire in Egypt’s Financial landscape

Banque du Caire plays a vital role in shaping the financial landscape of Egypt, acting as a key player in promoting investment, facilitating trade, and supporting economic growth. The bank’s broad range of services, including personal and corporate banking, microfinance, and investment options, makes it a critical entity for both individual customers and businesses looking to expand. With a strong focus on technological advancement, the bank has embraced digital solutions to enhance customer experiance and streamline operations, positioning itself at the forefront of Egypt’s evolving financial sector.

In recent discussions surrounding the stability and future of Banque du Caire, Prime Minister Mostafa Madbouly’s comments have reaffirmed the government’s commitment to maintaining state-owned banks as pillars of economic resilience. The key factors influencing the bank’s essential position include:

- Government support and regulatory frameworks that foster growth.

- Diversified financial products tailored to a wide array of customers.

- Strategic partnerships with international financial institutions.

- Responsiveness to market changes and customer needs.

This steadfast foundation not only reinforces the bank’s business model but also underscores its significance in a rapidly changing economic environment.

Investor Sentiment: How Rumors Impact Confidence in Egyptian Banking

In recent weeks, whispers surrounding the potential sale of Banque du Caire have stirred considerable investor sentiment within the Egyptian banking sector. Prime Minister Mostafa Madbouly’s emphatic denial of these rumors has sparked a debate about the fragile nature of confidence among stakeholders. The banking industry, frequently enough viewed as a barometer for economic stability, can be heavily influenced by speculation. Investors watch these developments closely, weighing the implications of such rumors on market viability and shareholder value.

Investor confidence can be swayed by a variety of factors, including:

- Market Stability: Rumors can lead to speculation-driven volatility, affecting stock prices.

- Trust in Management: Leadership responses to speculation can reinforce or erode investor trust.

- Economic Indicators: speculative scenarios can detract from genuine economic signals, clouding judgment.

- overall Sentiment: A single rumor can impact broader market sentiment, influencing decisions across industries.

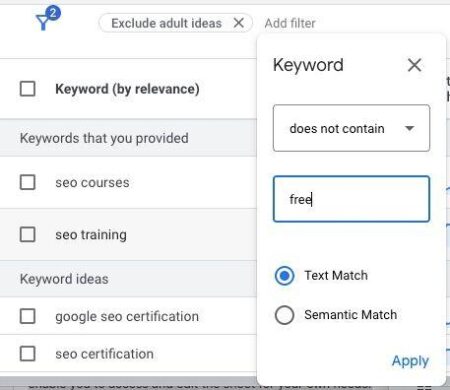

To better illustrate the ramifications of such rumors, consider the following table of recent trends in investor confidence levels compared to key events in the banking sector:

| Event | Confidence Level (1-10) | Market Reaction |

|---|---|---|

| Banque du Caire Sale Rumor | 4 | Sharp decline in share prices |

| Madbouly’s Denial | 7 | Gradual recovery in investor sentiment |

| Positive Economic Data | 8 | Strong market rally |

Future outlook for Banque du Caire Amidst Market uncertainty

In the wake of recent market fluctuations, Banque du Caire is navigating a landscape filled with both challenges and opportunities. While Prime Minister Madbouly’s denial of any potential sale has provided a sense of stability, the bank must now focus on strengthening its operational resilience. Key areas of focus include:

- Enhancing Digital Banking Services: As consumer preferences shift towards online options, the bank is likely to invest more in technology-driven solutions.

- Diversifying Investment Portfolio: To mitigate risks associated with market uncertainty, exploring new sectors and asset classes will be vital.

- Strengthening Customer Relations: Building trust and maintaining customer loyalty in turbulent times will be crucial for sustaining growth.

Moreover, the global economic environment continues to present unpredictable variables, making it essential for Banque du Caire to adopt agile strategies. An emphasis on strategic partnerships could pave the way for innovative financial products tailored to emerging market needs. The bank might consider:

| Strategic Focus Area | Potential Outcomes |

|---|---|

| Partnerships with Fintechs | Increased access to technology and younger demographics. |

| Green Banking Initiatives | Alignment with global sustainability trends, attracting environmentally conscious investors. |

| Community Investment Programs | Enhanced brand reputation and customer goodwill. |

Recommendations for Stakeholders in Light of Recent Developments

In the wake of Prime Minister Madbouly’s recent statements denying the rumors surrounding the sale of Banque du Caire, stakeholders must remain diligent in their ongoing assessments of the banking sector in Egypt. It is crucial for investors and financial analysts to monitor the government’s position on state-owned enterprises closely, as this can significantly influence market dynamics. Key considerations should include:

- Regulatory Changes: Stay updated on any new regulations that may emerge in response to the government’s fiscal policies.

- Market Sentiment: Gauge public and investor confidence regarding state-controlled banking institutions and their impact on economic stability.

- Strategic Partnerships: Explore potential alliances with local banks to mitigate risks associated with state ownership.

Moreover, financial institutions should prepare for potential volatility as market perceptions evolve. Stakeholders are advised to engage in proactive communication with key players in the market to gather insights and foster collaborative approaches.Consider implementing the following strategies:

| Strategy | Purpose |

|---|---|

| Risk Assessment Workshops | To identify and mitigate risks associated with government policies. |

| Investor Roundtables | To facilitate dialog between government officials and market investors. |

| Diverse Portfolio Development | To lessen the impact of concentrated investments in state-owned banks. |

In Retrospect

Prime Minister Mostafa Madbouly’s recent statements have firmly dismissed rumors surrounding the potential sale of Banque du caire, reassuring stakeholders and investors of the government’s commitment to maintaining the bank’s independence. As the economic landscape in Egypt continues to evolve, clarity and clarity regarding state-owned enterprises are crucial for fostering confidence within the financial sector. With the government focusing on strategic reforms and stability, the future of Banque du Caire remains pivotal not only for the banking industry but also for the broader economic framework of the nation. As developments unfold, attention will remain on how these clarifications impact investor sentiment and the overall market dynamics in Egypt.