In the ever-evolving landscape of Islamic finance, Kuwait Finance House (KFH) has made notable strides by expanding its footprint into egypt, a market ripe with potential. This expansion marks a pivotal moment not only for KFH but also for the broader Islamic finance sector, as it seeks to capitalize on the growing demand for Sharia-compliant financial products in the region.As KFH forges ahead, banking analysts and market observers are keenly watching this advancement, recognizing Egypt’s strategic position as a burgeoning hub for Islamic finance in the Middle East and North Africa. This article delves into the implications of KFH’s venture into Egypt,exploring the opportunities it presents,the challenges it may face,and what this move signifies for the future of Islamic finance in the region.

Kuwait Finance House Announces Strategic Expansion into Egypt

Kuwait Finance house (KFH) has officially announced its ambitious plans to expand its operations into the Egyptian market, marking a significant milestone in its growth strategy. This expansion aims to leverage Egypt’s booming economy and increasingly favorable regulatory environment for Islamic finance.By establishing a presence in the region, KFH intends to cater to a wider clientele, fostering financial inclusivity while adhering to the principles of Sharia-compliant banking.The decision aligns with KFH’s commitment to enhance its service offerings and tap into new business opportunities.

the expansion strategy rests on several key initiatives, including:

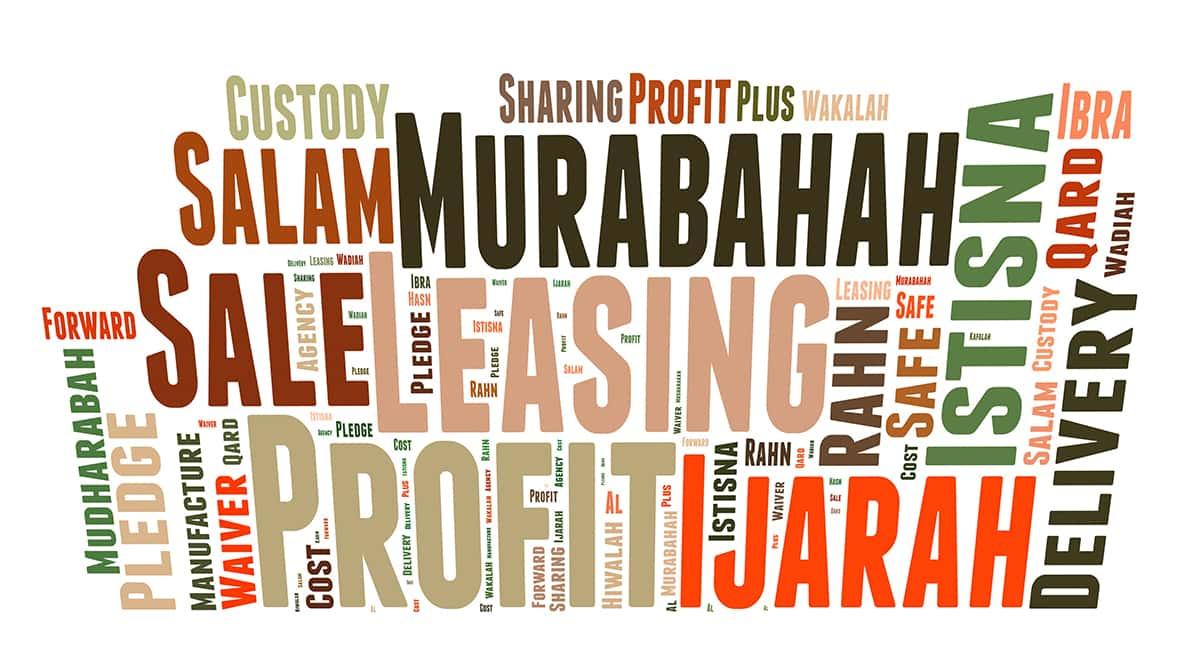

- Investment Diversification: KFH aims to introduce a range of Sharia-compliant investment products tailored to the needs of the Egyptian market.

- Digital Innovation: Emphasizing technological integration, KFH plans to enhance its digital banking services, making them accessible to a broader audience.

- Partnership Development: Strategic partnerships with local institutions will facilitate KFH’s market entry and growth, ensuring compliance with local regulations.

Furthermore,KFH’s entry into Egypt is expected to stimulate the local Islamic finance sector,providing much-needed competition and innovation. The Egyptian banking landscape, which is progressively leaning towards Islamic finance, presents KFH with a unique chance to position itself as a key player. Stakeholders in the industry are optimistic about the prospects this expansion offers, notably in terms of economic growth and financial stability within the region.

The Growing Demand for Islamic Finance in Egypt

The landscape of financial services in Egypt is undergoing a significant change, driven primarily by the rising popularity of Islamic finance. As the population increasingly seeks financial products that comply with Sharia principles, institutions are responding with an expanding array of offerings. Notably, Kuwait Finance House has recognized this shift and is making strategic moves to capture this burgeoning market. Their entry into the Egyptian financial scene signifies a growing interest among regional players to establish a foothold in a market with substantial potential for Islamic banking solutions.

This burgeoning demand is fueled by several factors:

- Increased Awareness: Manny Egyptians are becoming more educated about Islamic finance and its principles, leading to a greater appetite for financial products that align with their beliefs.

- Younger Demographics: A youthful population is driving innovation and a preference for modern financial solutions, including digital banking services that adhere to Islamic principles.

- Government Initiatives: Support from the Egyptian government in the form of regulatory frameworks has further encouraged the establishment and growth of Islamic financial institutions.

Impact of kuwait Finance House’s entry on the Local Banking Sector

The entry of Kuwait Finance House (KFH) into the egyptian market is poised to significantly alter the dynamics of the local banking sector. With its strong reputation in Islamic finance,KFH’s expansion is highly likely to introduce heightened competition among existing banks,particularly those aiming to enhance their Sharia-compliant offerings.The move may prompt local banks to innovate and improve their services to retain customers, potentially leading to a broader range of financing products and enhanced efficiency across the sector.

Additionally, KFH’s presence can stimulate investment and economic growth in Egypt, as the bank brings expertise and new capital to the market. This influx can encourage other Islamic financial institutions to tap into the growing demand for Sharia-compliant banking solutions. Consequently, we might witness:

- Increased collaboration: local banks may seek partnerships with KFH to leverage its experience.

- Enhanced customer awareness: KFH’s marketing efforts can educate consumers on the benefits of Islamic finance.

- Greater regulatory engagement: The Central Bank of egypt may enhance its regulatory framework to accommodate this burgeoning sector.

Regulatory Environment and Opportunities for Growth in Egypt

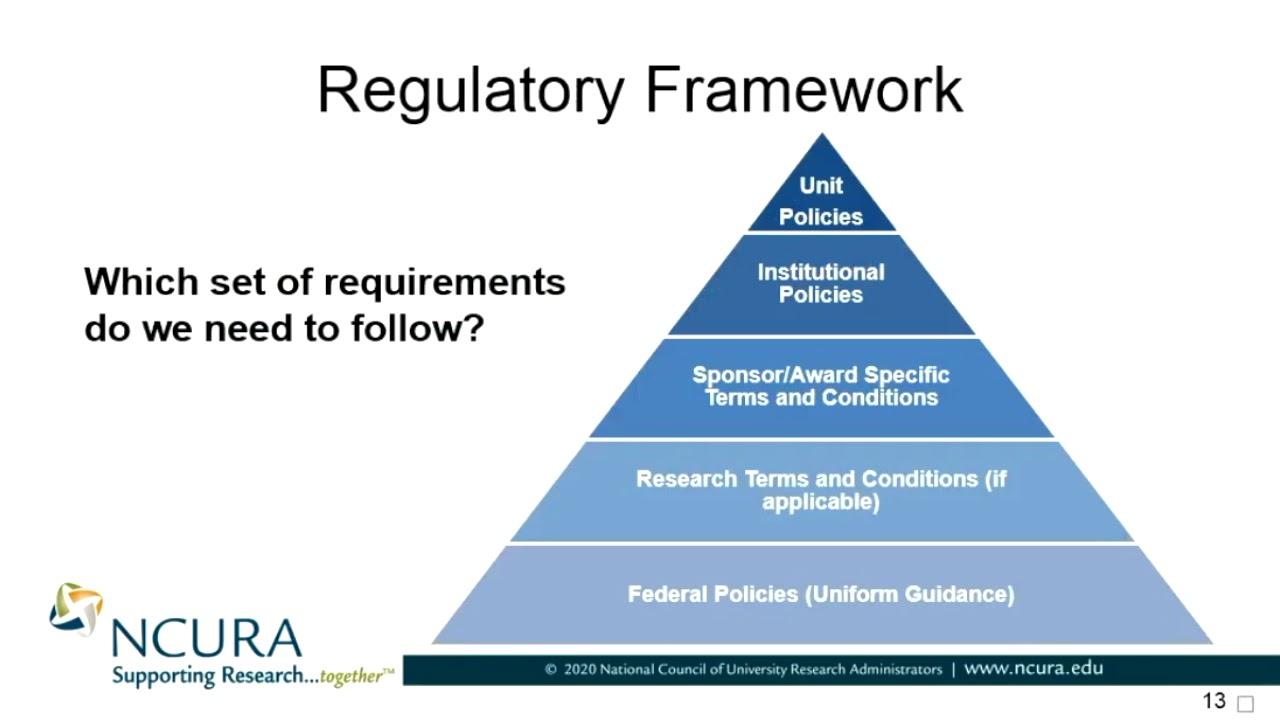

The regulatory landscape in egypt is progressively adapting to accommodate the growing demand for Islamic finance.The Central Bank of Egypt is taking significant steps to enhance the legislative framework, promoting a more conducive environment for Sharia-compliant financial products. Key initiatives include:

- Establishment of Regulatory Frameworks: New guidelines are being developed to standardize Islamic banking practices, ensuring they meet both Sharia principles and international norms.

- Encouragement for financial Inclusion: regulators are actively encouraging banks to extend their services to underserved populations, thereby increasing the overall financial penetration.

- Incentives for Innovation: The government is also offering incentives for the creation of innovative financial products, aimed specifically at attracting a broader customer base.

These developments present a multitude of opportunities for financial institutions.Notably, the expansion of Kuwait Finance House into the Egyptian market is a testament to the increasing attractiveness of the Islamic finance sector. This entry not only signifies confidence in Egypt’s economic environment but also highlights the potential for growth in Sharia-compliant services.The landscape is ripe for:

- Partnerships and Collaborations: Local banks and international Islamic institutions can form alliances to share expertise and resources.

- Investment in Fintech: With the rise of digital banking, there’s a pressing need for Sharia-compliant fintech solutions that cater to tech-savvy consumers.

- community Development Projects: There is a growing emphasis on financing projects that promote social welfare and development, aligned with Islamic finance principles.

Recommendations for Investors Looking to Navigate the Egyptian Market

Investors aiming to capitalize on the opportunities within the Egyptian market should adopt a multifaceted approach to navigate its unique landscape. understanding local regulations is paramount, as the legal framework can vary greatly from other regions. Investors should stay informed about recent legislative changes and compliance requirements specific to their sectors. Additionally, conducting thorough market research to identify trending industries will help to recognize high-potential investment opportunities. Key sectors currently thriving include renewable energy,real estate,and technology. Engaging with local experts can provide invaluable insights into market dynamics and consumer behavior.

Furthermore, forming strategic partnerships with Egyptian firms can bridge the cultural and operational gaps that foreign investors often face. Collaborating with local businesses not only facilitates smoother market entry but also enhances credibility and local expertise.investors should also consider the importance of risk management strategies tailored to the Egyptian context. This involves assessing geopolitical factors and economic stability, as well as diversifying portfolios to mitigate risks. A proactive approach in monitoring economic indicators and regional developments will empower investors to make informed decisions, maximizing their chances for success in Egypt’s evolving market landscape.

Future Trends in Islamic Finance Following Kuwait Finance House’s Expansion

the recent expansion of kuwait Finance House (KFH) into the Egyptian market is poised to set in motion a series of trends in Islamic finance that will impact the broader region. As KFH establishes its operations in Egypt, we can anticipate increased competition among islamic banks, which may enhance product offerings and customer services. This expansion signals a growing recognition of Egypt as a pivotal market,characterized by its unique demographics and a rising interest in Sharia-compliant financial solutions. The integration of technology in banking services is highly likely to accelerate, with Islamic finance institutions investing in digital platforms to capture a younger, tech-savvy clientele.

Furthermore, we may witness a surge in collaborative ventures among Islamic financial institutions across the region, aimed at pooling resources and sharing best practices. Key trends likely to emerge include:

- Increased Cross-Border Collaborations: Banks may form strategic alliances to enhance their service portfolios and reach a wider audience.

- Focus on Lasting Financing: Given the global emphasis on sustainability, Islamic finance institutions might prioritize eco-friendly projects and socially responsible investments.

- Regulatory Enhancements: Efforts to standardize regulations and compliance frameworks across countries could facilitate smoother operations for Islamic banks.

| Trend | Impact |

|---|---|

| Technological Integration | Enhanced efficiency and customer experience. |

| Sustainable financing | Attraction of socially conscious investors. |

| Collaboration Across borders | Improved resource sharing and risk management. |

To Wrap It Up

Kuwait Finance House’s expansion into Egypt marks a significant development in the realm of Islamic finance, highlighting the growing appetite for Sharia-compliant financial products in a country poised for economic growth. As the bank sets its sights on tapping into Egypt’s burgeoning market, this move not only underscores its commitment to providing innovative financial solutions but also aligns with broader trends within the Islamic finance sector. Stakeholders will be watching closely to see how this strategic expansion influences the competitive landscape and fosters further collaboration between financial institutions in the region. As the Islamic finance industry continues to evolve,Kuwait Finance House’s endeavors may very well serve as a catalyst for future growth and investment opportunities across the Arab world.